The Pipes Are Rattling — and Gold & Silver Are Pricing It In

Gold is pricing trust. Silver is pricing trust and industrial power.

In-depth analysis measuring assets, currencies, and economies in gold terms.Discover what true value looks like beyond fiat currency distortions.

Gold is pricing trust. Silver is pricing trust and industrial power.

Explore our in-depth analysis on assets, currencies, and economies measured in gold terms

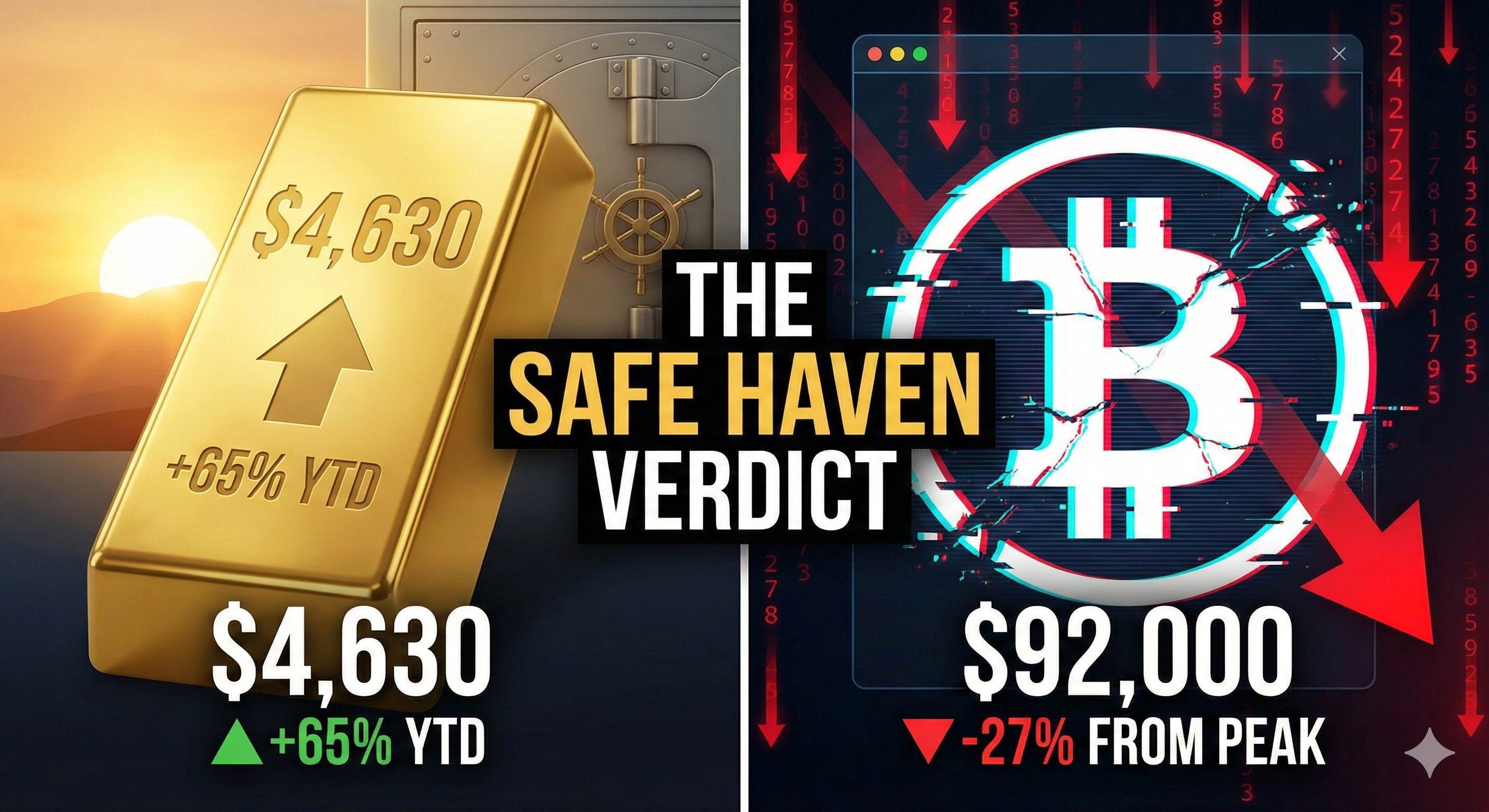

The debate is over. The market has spoken. And it didn’t choose the asset with a laser-eye profile picture.

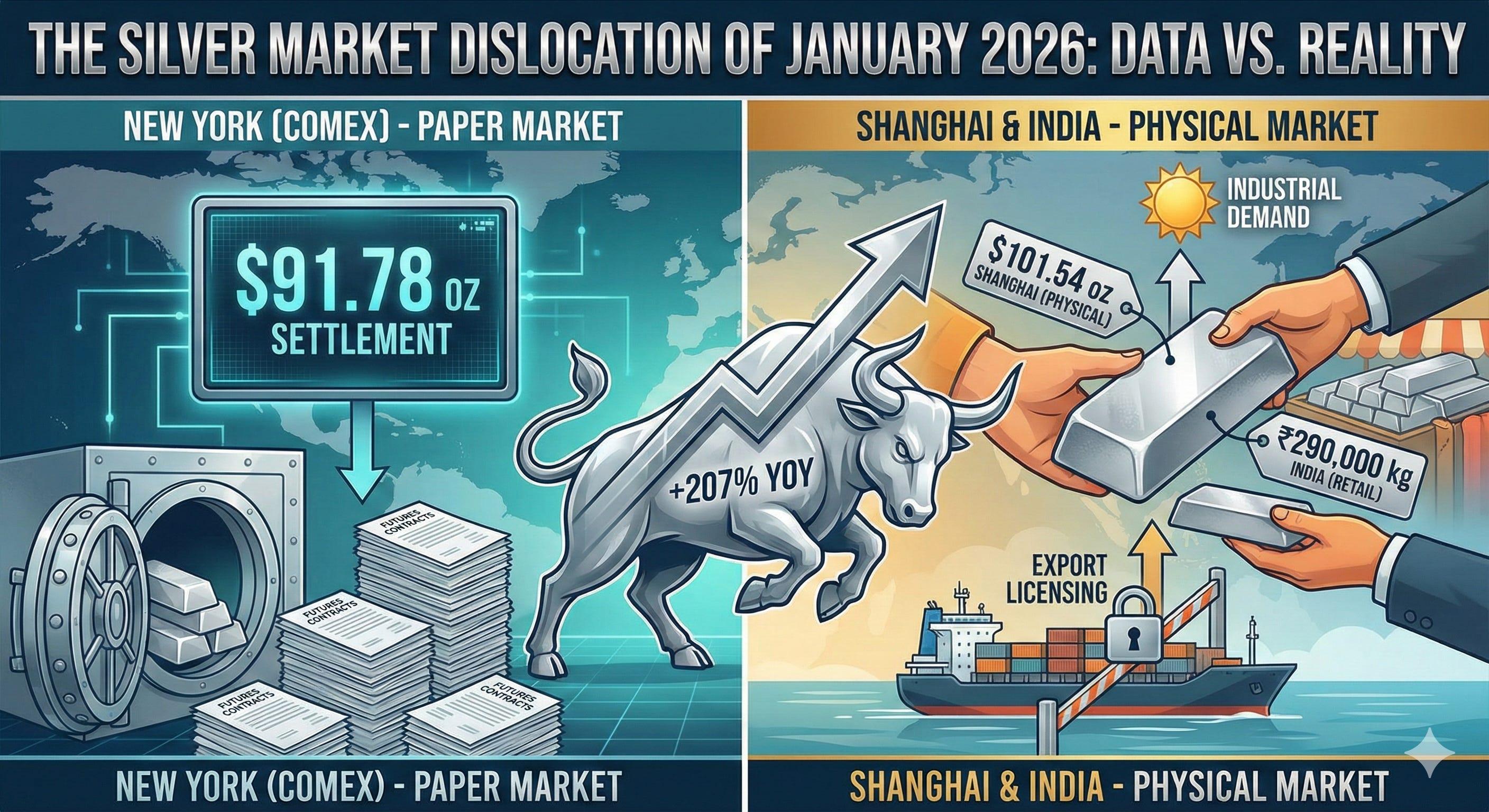

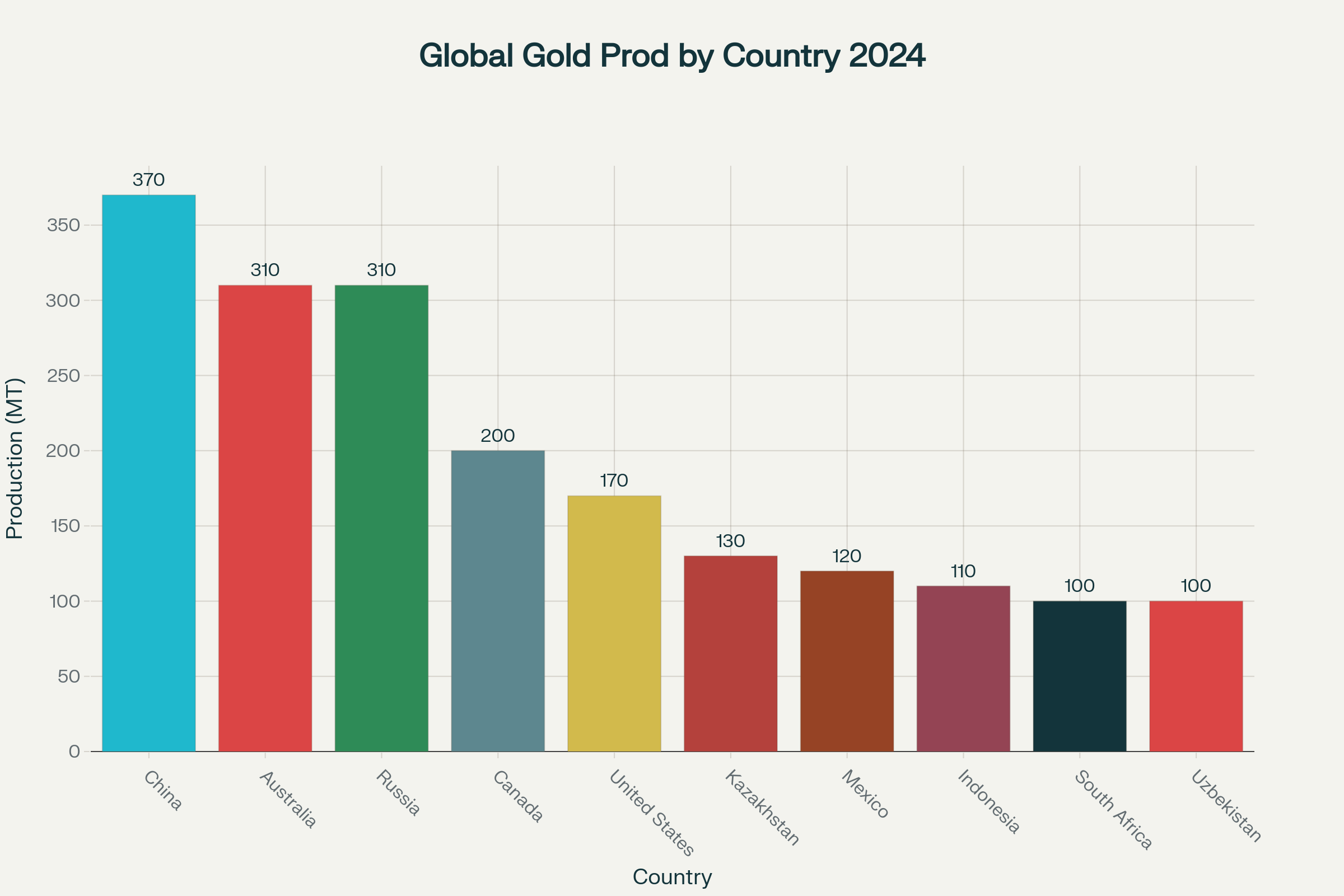

Analyzing the $10 spread between New York and Shanghai, the supply crunch in India, and the reality of physical shortages.

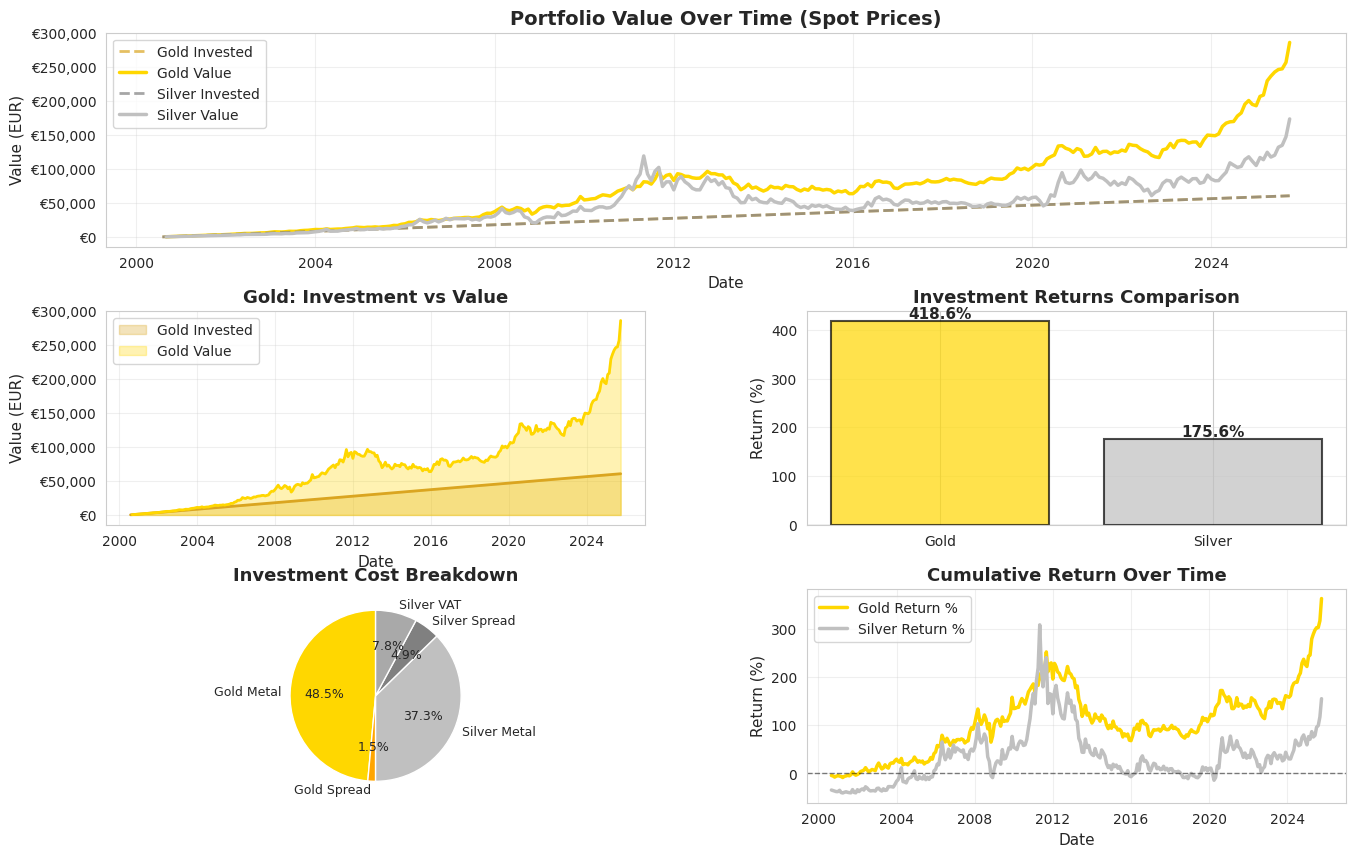

Silver stackers are losing 26 cents on every dollar to taxes and spreads. Here's the data they don't want you to see.

Why This Ancient Metric Could Help You Stack Smarter in 2025

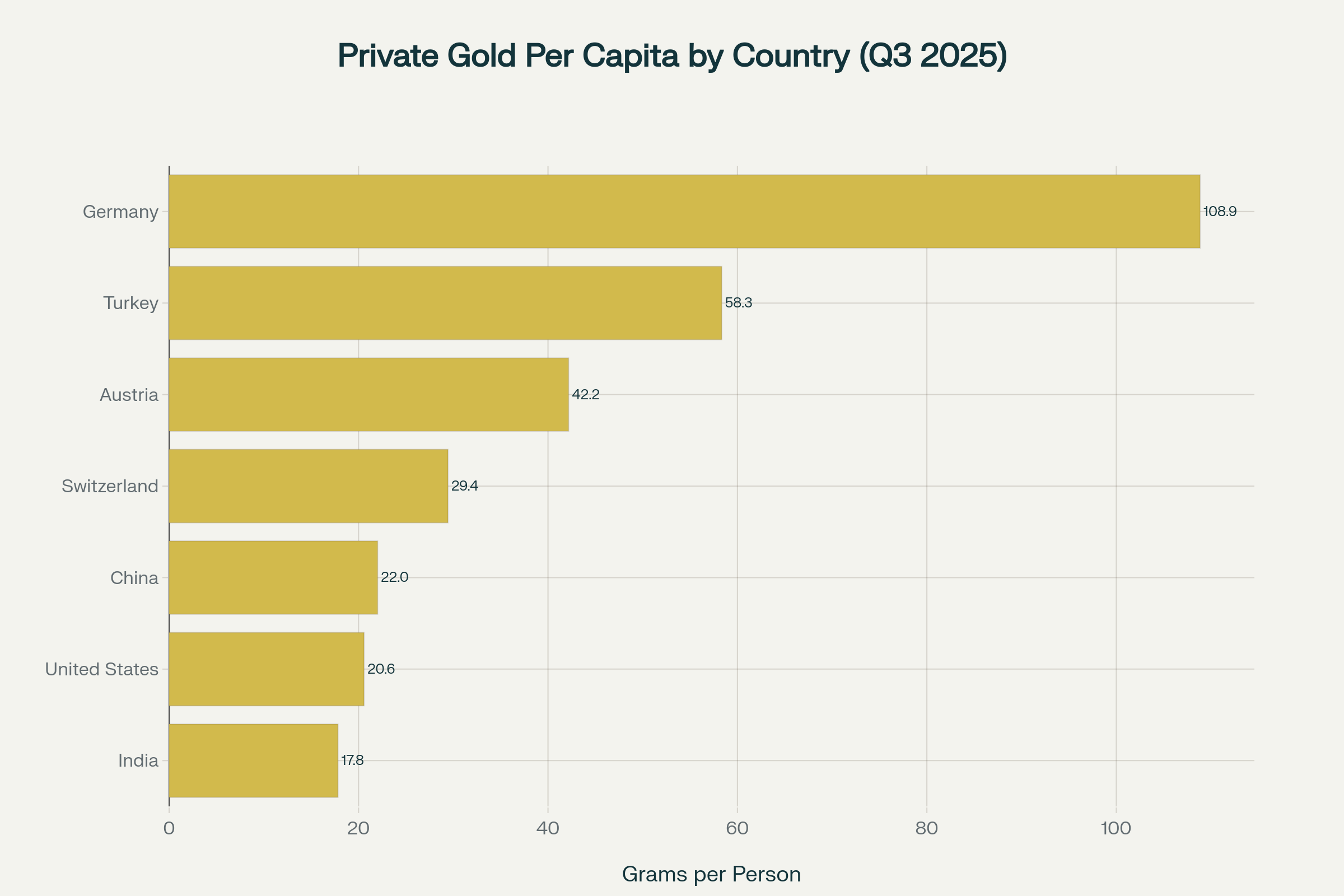

Where the world's private gold sits, who owns it, and why everyone's suddenly buying

A Roman soldier could buy a horse in 10 months. Can you buy a car in 10 months? Let's find out if modern engineers are actually poorer than ancient legionaries—and the answer might surprise you.

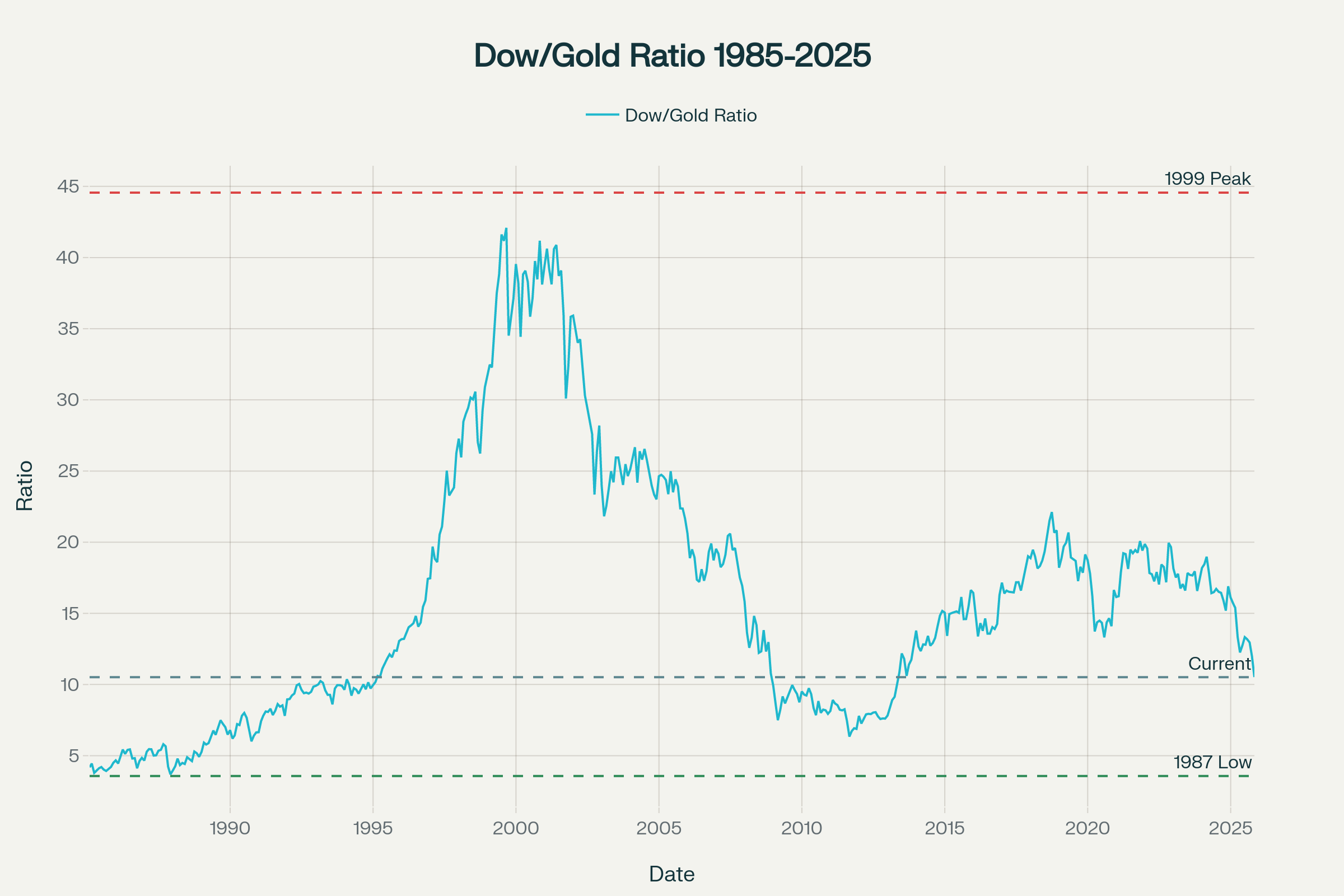

The century-old indicator that's flashing warning signs about stock market euphoria and the dollar's decline

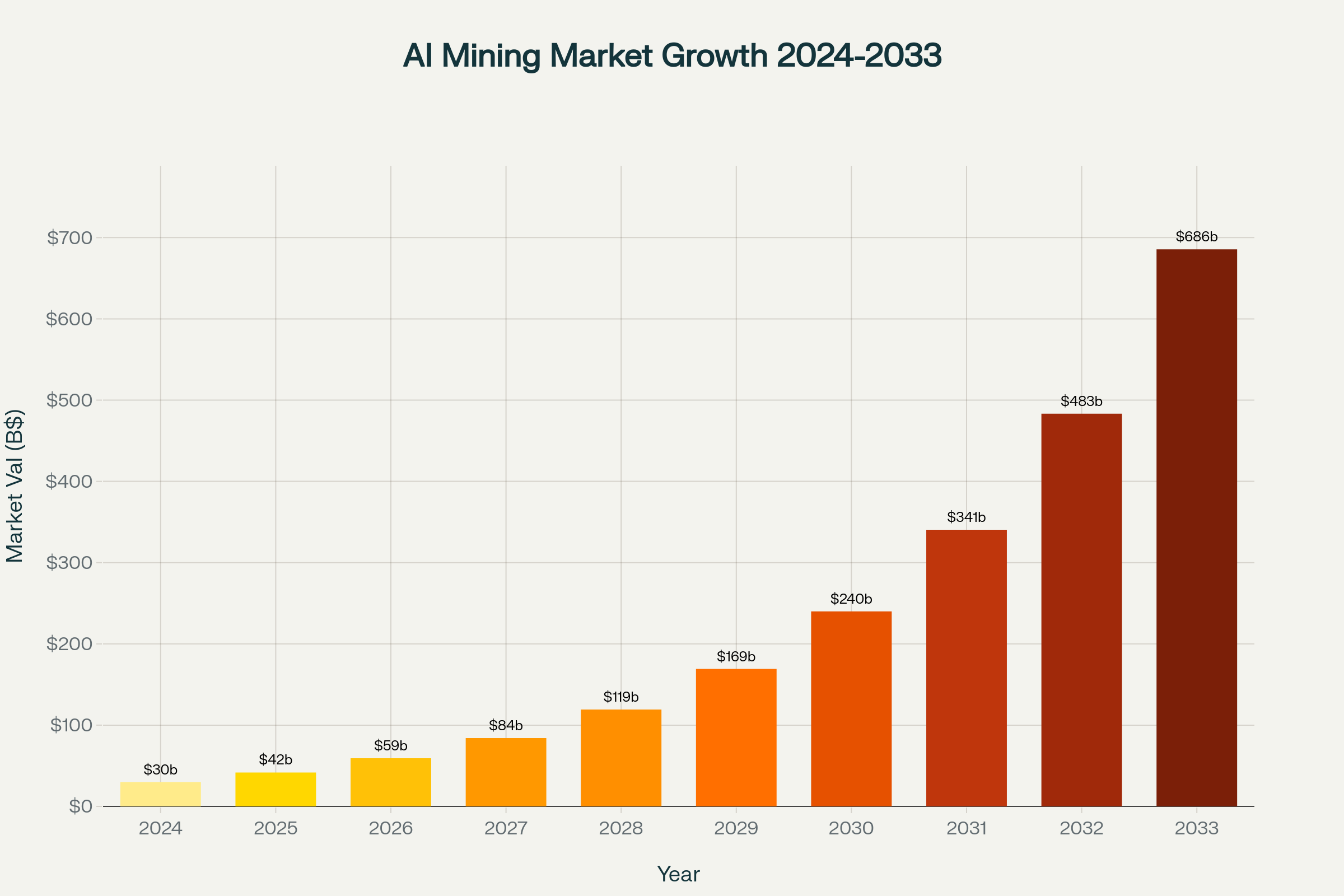

AI algorithms are achieving 75% exploration success rates in abandoned mines where human geologists hit just 0.5% — and they're finding billions in gold that was sitting there all along

Why the world's most profitable gold miners are investing billions in AI and automation despite soaring costs and shrinking ore grades

Get our latest analysis on assets, currencies, and economies measured in gold—delivered directly to your inbox.