As gold prices smashed through the $4,000-per-ounce barrier in Q3 2025, a fundamental transformation has been unfolding beneath the surface of global markets. This isn’t just another commodity rally—it’s a massive reallocation of private wealth into physical gold, driven by eroding trust in traditional currencies and a fundamental rethinking of what constitutes safe money. While central banks grab headlines with their unprecedented buying sprees, an equally dramatic story is playing out in households from Shanghai to Stuttgart, from Mumbai to Istanbul. Private citizens are accumulating gold at a pace not seen in generations, and the implications reach far beyond precious metals markets.

The New Gold Map: Who Holds What

China’s Strategic Accumulation Dominates Global Holdings

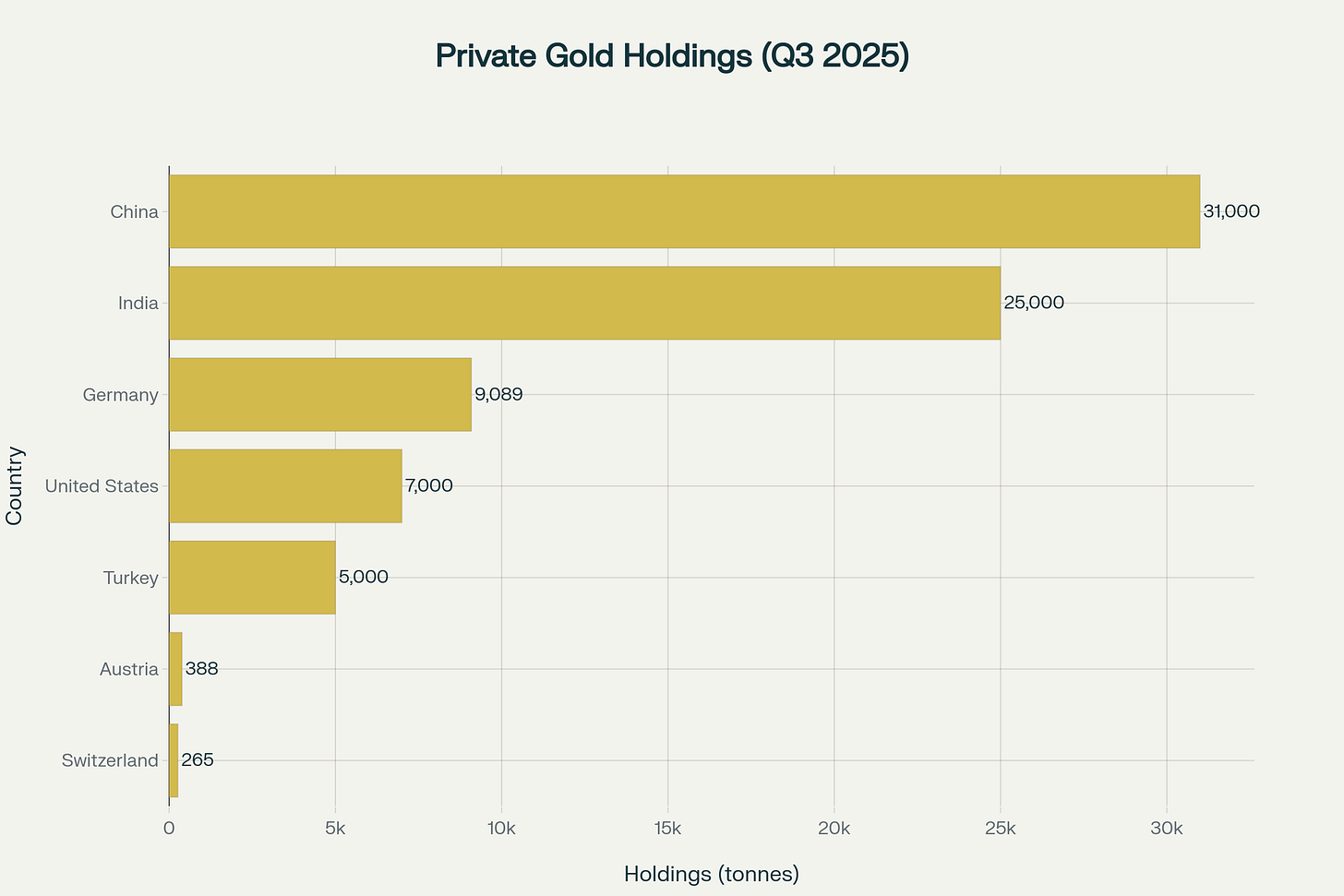

China has emerged as the undisputed leader in private gold ownership, with households now holding over 31,000 tonnes of the precious metal—a staggering figure that exceeds the combined official reserves of all central banks worldwide. This extraordinary accumulation represents a relatively recent phenomenon, directly tied to deliberate government policy initiatives launched after China was denied SDR reserve status by the IMF in 2015. Unlike India’s centuries-old cultural affinity for gold, China’s massive private holdings stem from an unprecedented national campaign where the government deployed billboard advertisements “the size of houses” alongside nationwide television campaigns explicitly promoting physical gold purchases.

The results have been remarkable. As of 2025, Chinese private gold holdings have surpassed 31,000 tons, making it the largest collective private ownership globally. This massive scale fundamentally transformed global gold distribution, with concentrated buying power from China’s gold-owning citizens becoming a structural factor in gold’s price appreciation from $1,000 to over $4,000 per ounce since the market opening. The government systematically reduced barriers to gold ownership by expanding retail access points, simplifying purchase processes, and developing consumer-friendly gold investment products, with local banks offering gold-linked savings vehicles while the Shanghai Gold Exchange expanded operations to facilitate easier public participation.

India’s Cultural Gold Dynasty Continues

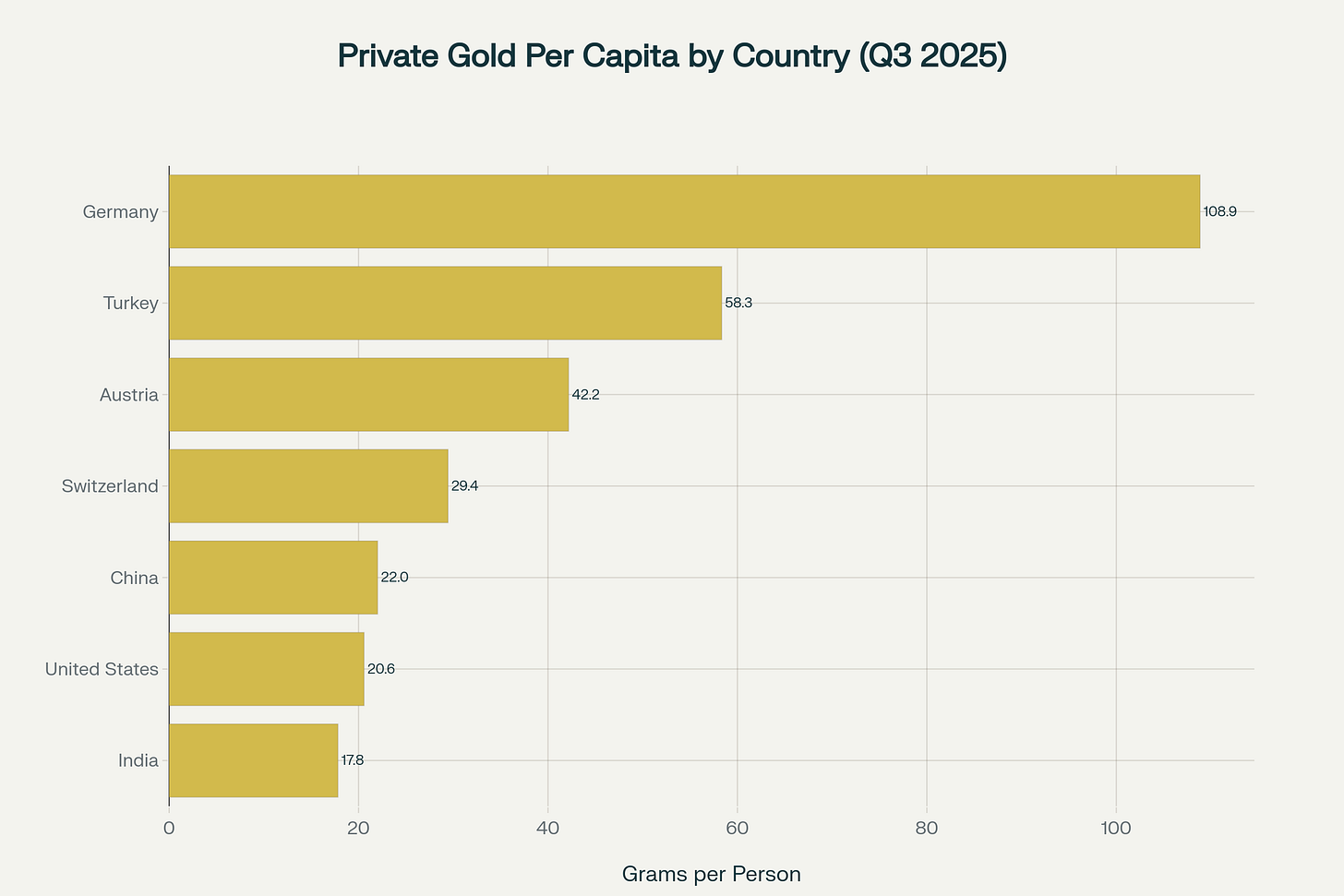

India maintains its position as the world’s second-largest holder of private gold, with households possessing approximately 25,000 tonnes—more than the combined official reserves of the United States, Germany, Italy, France, and Russia. This extraordinary accumulation reflects deep cultural traditions where gold serves simultaneously as adornment, financial security, and generational insurance. The 2013 survey conducted by the Federation of Indian Chambers of Commerce & Industry found that more than three quarters of Indians view the precious metal as a “safe investment,” with gold representing a regular line item in most Indian households’ budgets, comparable to what they spend annually on medical expenses and clothing.

Indian women alone hold approximately 11% of the world’s gold, with South India accounting for 40% of India’s total gold holdings and Tamil Nadu representing 28%. Gold functions as portable wealth in India—easily transported, universally recognized, and relatively difficult to trace during emergencies. The cultural significance extends far beyond mere wealth storage, with gold playing indispensable roles in weddings and religious festivals, where it’s not just valuable but stands for prosperity, good fortune, and status.

Germany’s Investment-Grade Approach

Germany presents a fascinating contrast to Asian gold cultures, with private households owning more than 9,089 tonnes valued at approximately €616 billion as of 2025. What distinguishes German gold ownership is its decidedly investment-focused character rather than cultural tradition. According to recent surveys from the World Gold Council, more than one-third of Germans have at some point invested in gold, and 28% still do, making it the third most commonly owned investment after savings accounts and equities. Remarkably, 93.2% of German gold investors express satisfaction with their gold investments.

German private households hold approximately 109.5 grams per person, making Germany the global leader in per capita private gold ownership despite having far smaller total holdings than China or India. This high per-capita figure reflects Germany’s historical experience with currency collapse and hyperinflation, creating a cultural memory that drives continued gold accumulation as an inflation hedge. The preference runs toward bars and coins of investment grade rather than jewelry, with most German gold stored either in home safes or bank-independent vault facilities that offer high security outside the traditional banking system.

The Turkish Exception: Digital Meets Traditional

Turkey occupies a unique position in the global private gold landscape, with an estimated 5,000 tonnes in private hands and a deep-rooted historical preference for gold representing approximately 15-20% of the average Turkish household’s savings portfolio. This cultural affinity stems back centuries, with many families passing down physical gold through generations as wealth preservation. What makes Turkey particularly interesting is how it has pioneered the integration of gold into modern banking systems while maintaining traditional investment patterns.

Turkish gold certificates on Borsa Istanbul reached a record 21% premium over physical gold in April 2025, marking an unprecedented divergence between digital and physical gold markets. In Q1 2025 alone, approximately 450,000 new gold trading accounts were opened across Turkish financial institutions, demonstrating the massive scale of participation in digital gold certificate trading. Turkey’s ongoing economic uncertainty, with inflation particularly high and the domestic lira under downward pressure against the US dollar and euro, has accelerated the trend of viewing gold as a hedge against currency volatility and inflation pressures.

Cultural Forces Shaping Gold Ownership

Asian Gold Traditions: Beyond Investment

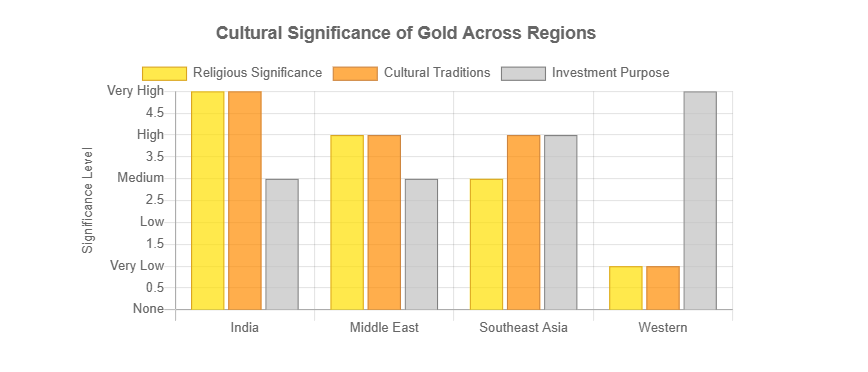

The stark differences in gold ownership patterns between Western and Asian societies reveal profound cultural variations in how gold is conceptualized and utilized. In India, gold holds deep religious significance associated with the goddess Lakshmi, who represents wealth and prosperity. Indian brides often wear intricate gold jewelry sets weighing several pounds, with each piece carrying specific cultural significance, while the mangalsutra—a gold necklace given by the groom—symbolizes the sacred bond of marriage and is worn throughout a woman’s married life.

Middle Eastern cultures have long viewed gold as a bridge between earthly and divine realms, with gold holding deep symbolic meanings representing prosperity, good fortune, and status. Gold is gifted to brides during wedding preparations as a tangible expression of a groom’s commitment and ability to provide, serving as both adornment and financial security. The region’s famous gold souks function as more than just shops—they are cultural centers where the art of gold negotiation has been refined over generations, with buyers and sellers engaging in sophisticated give-and-take while ensuring authenticity through strict purity standards.

Southeast Asian nations like Vietnam and Thailand demonstrate equally strong cultural connections to gold ownership. In Vietnam, the tradition of “New year salt, year-end gold” symbolizes good luck and prosperity, with purchasing gold at year’s end signifying wealth and success. Gold and the US dollar became the primary investment options when Vietnam’s banking and stock markets proved unreliable, with citizens storing gold at home to maintain liquidity when paid in a depreciating currency. Thai culture integrates gold so deeply that the old name for Thailand—Siam—actually means gold in Sanskrit, with Thailand maintaining its own traditional unit of measurement for gold known as the bot, equal to 15.16 grams.

Western Pragmatism: Gold as Financial Asset

Western cultures, particularly in Europe and North America, primarily view gold as a financial asset serving as both an investment vehicle and store of value. While gold’s historical significance as currency has diminished, it remains regarded as a safe haven during times of economic or financial uncertainty, with investors turning to gold as a hedge against inflation or market volatility. This financial-oriented view helps maintain steady demand in the global market, particularly during periods of economic downturns or uncertainty, though it contrasts sharply with regions where gold is deeply embedded in cultural and religious practices.

The perception differences manifest in purchasing patterns, with Western investors preferring standardized bars, coins, and ETF products over jewelry, focusing on purity, liquidity, and storage efficiency. German investors, for instance, typically seek 99.99% pure gold bars from recognized refiners, storing them in high-security vaults rather than wearing them as adornment. This pragmatic approach reflects a view of gold primarily as portfolio diversification and wealth preservation rather than cultural expression or religious significance.

The Private Gold Rush: Losing Trust, Finding Gold

Accelerating Loss of Faith in Traditional Currencies

The period from 2022 through Q3 2025 witnessed an unprecedented erosion of trust in traditional reserve currencies, fundamentally reshaping private investment behavior worldwide. Gold’s surge past $4,000 per ounce reflects more than rate expectations or dollar weakness—it signals a fundamental shift in investor psychology amid increasing geopolitical fragmentation. Western sanctions, asset freezes, and concerns over fiscal sustainability have eroded confidence in traditional safe havens like the US dollar and Treasuries, pushing institutional and sovereign investors toward tangible assets outside the financial system.

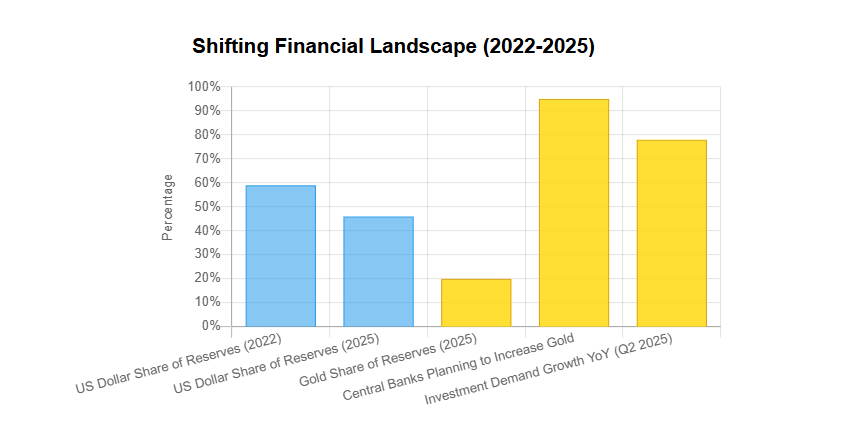

The US dollar’s share of global reserves has declined from approximately 59% in 2022 to roughly 46% by mid-2025, while gold’s share has simultaneously risen to 20%, surpassing the euro for the first time in history. A survey of 73 central banks conducted by the World Gold Council revealed that 95% expect to increase gold holdings over the next 12 months, while nearly three-quarters anticipate shrinking their dollar reserves. This structural shift reflects persistent concerns about US fiscal trajectories, mounting national debt approaching $37 trillion, political battles clouding the dollar’s standing as the world’s reserve currency, and questions about Federal Reserve independence amid political pressures.

Record Investment Demand Signals Paradigm Shift

Private investment demand for gold reached extraordinary levels in Q3 2025, demonstrating the intensity of the ongoing gold rush. Global investment demand grew by 78% year-over-year in Q2 2025, reaching 552 metric tons and representing the highest quarterly demand since the World Gold Council began tracking this metric. Gold ETF inflows have been particularly dramatic, with Western exchange-traded funds experiencing record inflows of $26 billion in Q3 2025, with North American markets accounting for $16.1 billion of this total.

Total assets under management in gold ETFs surged to $472 billion by the end of Q3 2025, a 23% increase over the previous quarter, with holdings rising to 3,838 metric tons—approaching the all-time record of 3,929 metric tons recorded in November 2020. Unlike previous gold rallies driven primarily by speculative positioning, the current uptrend features balanced participation across investor categories, potentially indicating greater sustainability. Retail interest in physical gold has spurred demand particularly in Asia, where the cultural significance of owning gold bars and jewelry remains strong, with many buyers eager to secure purchases even as prices rise.

Geopolitical Uncertainty as Primary Catalyst

Geopolitical tensions have created sustained uncertainty premiums across asset classes throughout 2025, with gold benefiting as the primary safe-haven destination. Current conflicts and trade disputes continue supporting elevated risk premiums, with President Donald Trump’s trade policies throughout 2025—including various tariff measures—contributing to market uncertainty that traditionally favors precious metals allocation. The October 2025 rally demonstrates gold’s acute responsiveness to policy uncertainty, particularly regarding trade relationships and international sanctions.

Regional conflicts spanning from Ukraine to the Middle East have maintained constant pressure on markets, with investors seeking assets that preserve value regardless of geopolitical outcomes. Gold’s universal acceptability and physical nature make it uniquely suited for emergency liquidity needs when normal financial channels face disruption. Central banks understand that gold represents financial sovereignty, with substantial reserves signaling to markets and citizens that a nation’s financial foundation extends beyond digital entries and government promises.

The Emerging Market Acceleration

Emerging market investors have led the private gold rush with particular intensity, driven by currency volatility and inflation concerns that developed-world investors experience less acutely. In Turkey, where inflation remains elevated despite recent declines and the lira faces downward pressure, demand for gold ranks among the world’s highest. Anxious consumers in Vietnam and Thailand have rushed to buy gold, creating visible queues outside banks that have persisted for months—vivid scenes underscoring the mounting economic alarm rippling through Southeast Asia.

These investors face the dual pressure of inflation working against them while their local currencies depreciate against the dollar, creating an urgent need for wealth protection. Gold functions as practical insurance in countries experiencing economic volatility, offering portable wealth that is easily transported, universally recognized, and relatively difficult to trace. China’s bid to become a global gold custodian has added structural support to the market, with Chinese citizens doubling gold investments as restrictions on real estate investment and cryptocurrency narrowed alternative options.

The Outlook: Where Private Gold Demand Heads Next

Price Forecasts Reflect Continued Strength

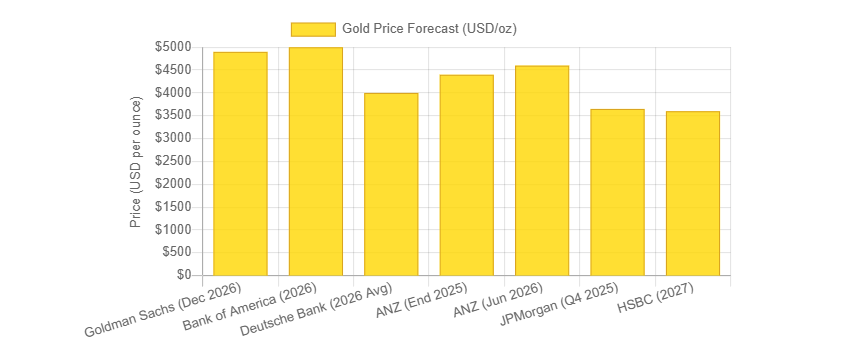

Major financial institutions have dramatically revised their gold price forecasts upward as prices shattered previous targets, with projections suggesting substantial further gains through 2026. Goldman Sachs leads with the most aggressive forecast, projecting $4,900 by December 2026—a 23% increase from current levels—expecting emerging market central banks to average 80 tonnes of purchases in 2025 and 70 tonnes in 2026. Bank of America has hiked its 2026 gold price forecast to $5,000 per ounce with an anticipated average around $4,400, acknowledging that a 14% increase in investment demand similar to 2025’s trend could elevate gold to $5,000.

Deutsche Bank raised its 2026 average forecast to $4,000 per ounce from $3,700, citing official demand running at double the 10-year average and recycled gold supply coming in 4% lower than expected. HSBC lifted its 2027 forecast to $3,600 from $2,925 and introduced a 2028 forecast of $3,330, while JPMorgan offered more conservative estimates targeting $3,500-$3,800 for Q4 2025. ANZ anticipates gold reaching $4,400 per ounce by end-2025, driven by rising geopolitical, economic, and financial uncertainties, with expectations for gold to peak near $4,600 by June 2026 before easing in the second half.

Structural Demand Factors Remain Firmly in Place

The factors supporting private gold accumulation appear structural rather than cyclical, suggesting sustained elevated demand through the coming years. Central banks, especially from emerging markets, continue serving as a cornerstone of gold demand as they diversify reserves away from the US dollar, with persistent buying creating a price floor that cushions market corrections. In Q4 2025, three critical factors will shape markets: whether reserve managers continue buying on price dips during yield-driven pullbacks, how sanctions and currency volatility shape reserve decisions, and whether gold miners pause or step up de-hedging.

Seasonal factors favor continued strength, with festival and wedding demand in India typically strengthening late in the year, while year-end portfolio rebalancing often favors safe-haven assets like bullion. The sustained purchasing by monetary authorities signals a fundamental shift in global reserve management strategies, providing consistent support for gold prices and potentially creating a higher price floor than historical averages would suggest. This structural change affects currency valuations, bond yields, interest rate expectations, broader asset allocation strategies, and development of new financial instruments linked to gold.

Potential Headwinds and Correction Risks

Despite bullish fundamentals, several factors could trigger short-term corrections or moderate the pace of gains. A sharp and lasting rebound in real yields or rapid rise in the US dollar would tighten global financial conditions and dampen demand outside the United States. Widespread conflict resolution—though appearing unlikely in the current environment—could see gold give back 12-17% of recent gains as investors rotate toward risk assets. The World Gold Council acknowledges that while strategic foundations remain strong, short-term scenarios could lead some gold investors to realize profits.

The rapid price rise itself may dampen retail interest at current elevated levels, with portfolio allocations to gold potentially approaching points where rebalancing toward other assets becomes necessary. High prices have already taken their toll on jewelry consumption, with Q2 2025 jewelry demand contracting 14% year-over-year to 341 tons—the lowest level since the pandemic-impacted Q3 2020. Price sensitivity varies significantly across regions, with India and China—the largest traditional consumers—showing the most sensitivity, potentially limiting physical demand growth even as investment demand remains robust.

The transformation of private gold ownership through Q3 2025 represents far more than a commodity market phenomenon—it reflects a fundamental reassessment of wealth, trust, and financial security in an increasingly uncertain world. From China’s government-orchestrated accumulation campaign to Germany’s methodical investment approach, from India’s millennia-old cultural traditions to Turkey’s innovative digital integration, private investors worldwide are voting with their wallets. They’re choosing the tangible over the digital, the ancient over the modern, and the proven over the promised. Whether this marks the beginning of a new monetary order or a temporary crisis of confidence remains to be seen, but one thing is certain: the private sector’s relationship with gold has entered a new chapter, and the implications will reshape wealth preservation strategies for years to come.

The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. Gold prices are subject to market volatility, and forecasts may not materialize as predicted. Past performance is not indicative of future results. Investors should conduct thorough research and consult with qualified financial professionals before making any investment decisions related to precious metals or other assets. The shifting landscape of global reserves and investment patterns described herein reflects reported market trends but does not guarantee similar outcomes in the future.