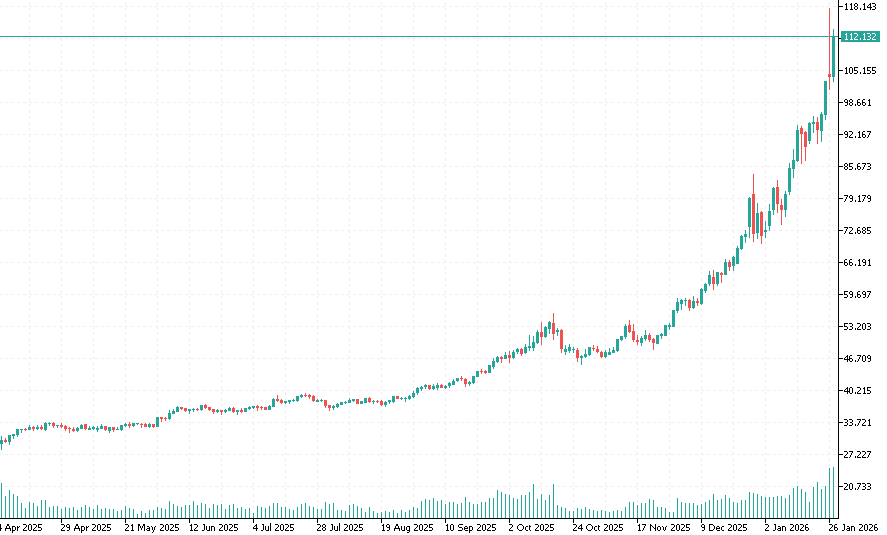

As of publication, gold trades around $5,179/oz and silver around $112.132/oz.

At those levels, the story stops being “nice rally” and becomes “system repricing.” Not because the world is ending, but because the market is putting a higher price on three things that usually feel free:

Trust (in policy and institutions)

Access (to liquidity, collateral, and supply)

Reliability (that the rules won’t change mid-game)

Gold is the cleanest expression of that shift. Silver is where it gets more interesting: a hard-asset alternative and a strategic industrial input in a world that’s treating supply chains like national security.

Why gold moves first when confidence gets expensive

Modern markets run on a simple assumption: the “risk-free” core of the system—Treasuries and short-term funding—will remain smooth, liquid, and dependable.

When that assumption feels less certain, investors gravitate toward assets that don’t rely on:

a counterparty,

a clearing chain,

a funding rollover,

or political permission.

That’s gold’s lane. It’s not that gold “predicts” crises. It’s that gold is the easiest way to own trust outside the system.

The under-the-hood pressure: collateral and short-term funding

If you want to see stress before it hits headlines, watch the pipes: repo (the market where cash and Treasury collateral trade hands, often overnight).

Two recent tells matter:

Backstop use at scale. At year-end 2025, firms tapped the New York Fed’s Standing Repo Facility for a record $74.6B on the final trading day. That’s not proof of a meltdown—year-end is a special environment—but it does show how quickly the system leans on official plumbing when private balance sheets pull back.

Funding staying stubbornly tight even after rate cuts. Reuters reported that in late 2025, GC repo rates repeatedly printed at or above the top of the Fed’s target range, reflecting liquidity strain heading into year-end amid heavy bill issuance and higher repo demand.

The punchline: the system still works—but it works with less slack, more “managed” behavior, and more sensitivity to calendar effects and policy.

Gold tends to thrive in exactly that kind of regime.

Silver’s repricing: hard asset + strategic industry exposure

Silver doesn’t behave like a smaller gold. It behaves like a different animal:

smaller and thinner market

higher volatility

meaningful industrial dependence

supply that doesn’t ramp quickly (because much silver production is a byproduct of other mining)

What’s changed is the frame. Silver is increasingly being treated less like “just a commodity” and more like strategic material—because it sits directly inside electronics, power infrastructure, and solar supply chains.

Industrial demand is not a side story anymore

Recent reporting cites industrial applications at roughly 60% of silver demand, a meaningful step up versus past decades.

And the physical market has shown signs of tightness, including a notable premium in Shanghai versus Western benchmarks during this rally.

This matters for investors because it makes silver feel like a “two-in-one” asset:

exposure to real industrial buildout (electrification, electronics, solar, grid upgrades)

plus a hard-asset alternative for those uneasy about policy and institutions

Policy is now part of silver’s price

Here’s the clean, factual core of the policy shift—and what it implies.

China: exporter “whitelist” + licensing friction

China’s Ministry of Commerce announced that 44 companies are allowed to export silver for 2026–2027—a controlled exporter framework rather than a free-for-all export market.

Separately, analysis of the new rules notes an additional licensing step for these exporters, which adds friction and cost even without explicit quotas.

Implication: when exports run through approved channels and licensing, supply becomes more sensitive to administrative decisions—timing, paperwork, prioritization, and domestic needs. Markets typically price that as a strategic premium.

United States: strategic designation via “critical minerals”

On November 7, 2025, the U.S. published its Final 2025 List of Critical Minerals, explicitly recommending and adding silver among new inclusions.

The Financial Times reported on the same shift and emphasized what it tends to trigger: more government support for domestic projects and the possibility of trade-policy tools becoming relevant.

Implication: “critical mineral” status doesn’t magically create supply, but it does pull silver into the realm of strategic planning—permitting priority, financing attention, stockpile discussions, and tighter supply-chain scrutiny.

Put China and the U.S. together and the signal is straightforward: silver is increasingly treated like an input that matters for national capacity, not just a metal that trades on screens.

Why moves like this feel “historical”

Big repricings in monetary metals often happen when the market starts questioning:

how stable the rules are,

whether liquidity is unconditional,

and whether strategic inputs will remain freely available.

The system doesn’t need to “break” for this to happen. It only needs to feel more conditional.

A Congressional Research Service report on Treasury market disruptions describes how, in stress episodes, intermediation can be overwhelmed and repo financing can become scarce, prompting official responses (facilities, purchases, repo lending).

That’s the backdrop: a world where collateral and liquidity are enormous… and sometimes not as frictionless as the textbooks suggest.

What to watch next (the practical list)

If this is a regime shift—not just a blow-off—confirmation tends to show up here:

Funding-market tightness outside calendar dates

Persistent elevation matters more than year-end spikes.Policy headlines that increase friction

Export licensing frameworks, critical-minerals actions, stockpiling language, procurement priorities.Physical tightness indicators

Lease rates, regional premiums (e.g., Shanghai vs London), and signs that “paper price” and “available metal” aren’t moving together.Silver supply/demand balance

The Silver Institute has discussed persistent structural deficits in recent years—watch whether high prices ease industrial demand or whether constraints keep biting.

Closing thought

Gold at $5,179 says: trust is expensive.

Silver at $112 says: trust is expensive—and strategic inputs are getting politicized.

When liquidity, collateral, and supply chains start to feel conditional, markets reprice the assets that feel unconditional. Sometimes slowly. Sometimes all at once.

Not financial advice. Silver especially can reverse violently—position sizing and time horizon matter.