Across Europe and beyond, millions of investors are stacking silver believing they’re getting better value than gold. After all, at $52 per ounce versus gold’s $4,316, silver seems accessible—you can hold actual ounces in your hand for the price of a nice dinner. But here’s what the shiny metal won’t tell you: by the time you factor in VAT and dealer premiums, you’re losing over a quarter of every dollar before the metal even moves an inch in price.

Let me show you the real numbers, because this isn’t about gold snobbery—it’s about math that directly impacts your wealth.

The Tax Advantage Nobody Talks About

Here’s the fundamental difference that changes everything: gold is VAT-exempt across the European Union, while silver gets hammered with a 21% tax in most countries. This isn’t a small detail. It’s the single biggest factor that makes gold the smarter buy for regular investors putting away $200 a month.

The exemption exists because EU regulators classified investment gold as a financial instrument back in 1999, recognizing its role as a store of wealth. Gold bars with 99.5% purity and coins minted after 1800 with 90% purity qualify as “investment gold” and trade VAT-free across all member states. Walk into any reputable dealer in Germany, France, Netherlands, or Ireland, and you’ll pay zero VAT on gold.

Silver? Not so lucky. Because silver serves critical industrial functions—solar panels, electronics, medical devices—it’s taxed as a commodity. That 21% VAT applies at purchase in most EU countries, and it’s collected immediately. From January 2025, even the margin scheme loopholes that allowed some silver coins to trade at reduced rates were largely closed, making the full VAT rate unavoidable for new silver purchases.

The Spread Problem Gets Worse With Silver

Beyond VAT, there’s another hidden cost: dealer premiums. Every physical precious metal trades above its “spot price”—the wholesale rate—because someone has to mint, transport, store, and sell it to you. But silver’s premiums are dramatically higher than gold’s.

Current dealer premiums in 2025:

Gold bars and coins: 1.5% to 5% for standard bullion products

Silver coins and bars: 8% to 25% for comparable products

Why the difference? Silver’s lower per-ounce value means fixed costs (minting dies, security, distribution) represent a bigger percentage of the final price. A $50 minting and handling cost on a $4,300 gold coin is barely noticeable. That same $50 on a $52 silver coin? That’s nearly a 100% markup right there.

During 2025’s silver squeeze—when physical silver became scarce in London trading hubs—premiums spiked even higher, with some products commanding 20-30% over spot. Gold premiums, by contrast, remained relatively stable even during volatile periods.

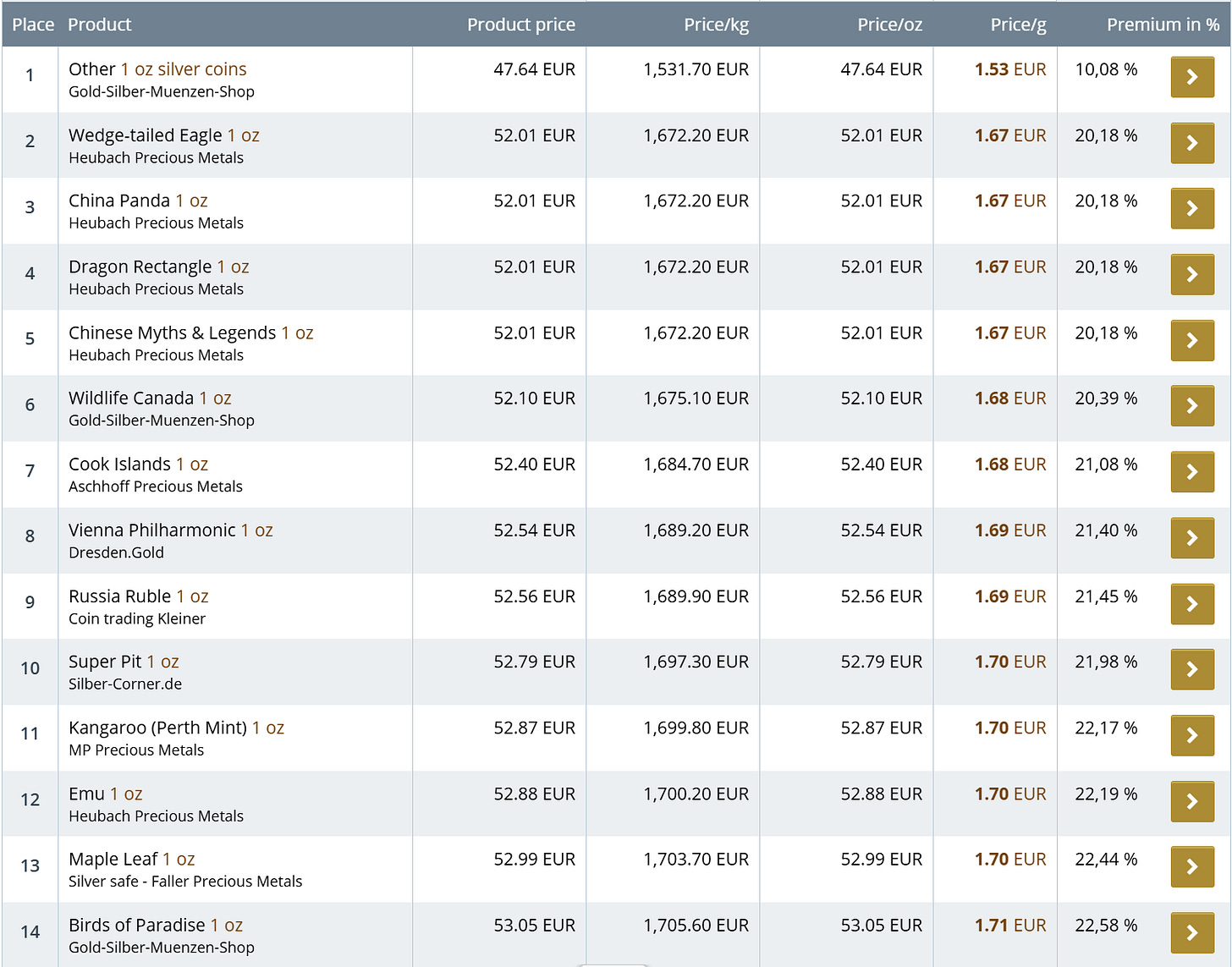

The premium problem in action: these are today’s actual retail prices for identical 1 oz silver coins across European dealers (don’t forget there will be packaging and transport costs too):

The Long-Term Reality: 25 Years of Data

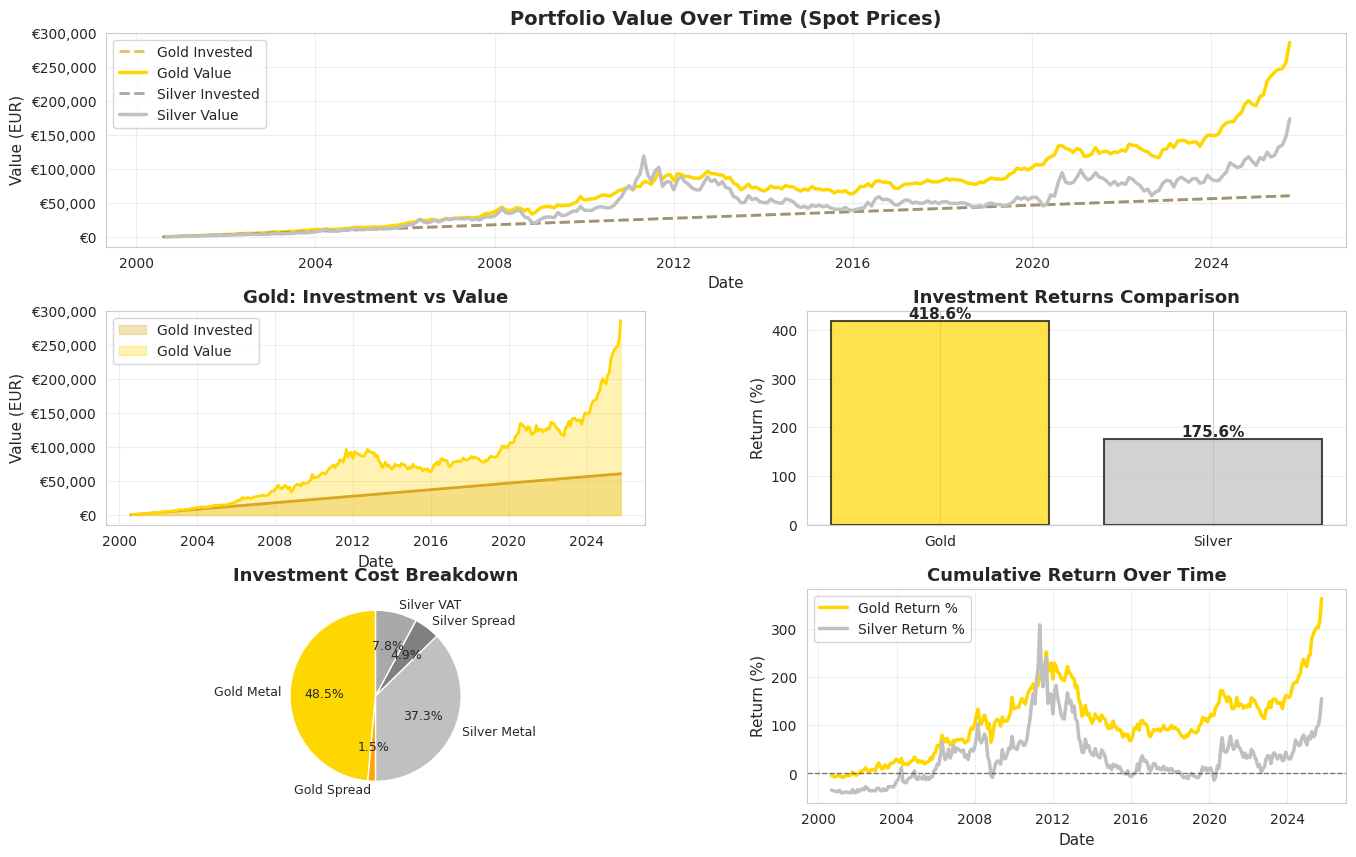

But what happens over the long haul? I ran a comprehensive simulation tracking monthly €200 investments in both metals from January 2000 through October 2025—303 months of real market data, incorporating actual VAT rates and dealer spreads throughout the entire period.

The results are stark:

Gold Performance (2000-2025):

Total invested: €60,600

Metal accumulated: 80.38 ounces

Average purchase price: €753.87/oz (including 3% spreads)

Current value: €314,281

Total return: 418.61%

Volatility: 4.74% monthly standard deviation

Silver Performance (2000-2025):

Total invested: €60,600

Metal accumulated: 3,989.73 ounces

Average purchase price: €15.19/oz (including 13% spreads + 21% VAT)

Current value: €166,995

Total return: 175.57%

Volatility: 9.14% monthly standard deviation

Gold outperformed silver in 298 out of 303 months—that’s 98.3% of the time. Silver only managed to beat gold during two brief periods in 2011, totaling just 5 months over a quarter-century.

The performance gap? A staggering 243 percentage points. The gold investor ended up with €147,285 more wealth than the silver investor, despite both investing the exact same amount every single month.

The Cost Breakdown That Explains Everything

Here’s where the math gets brutal for silver investors:

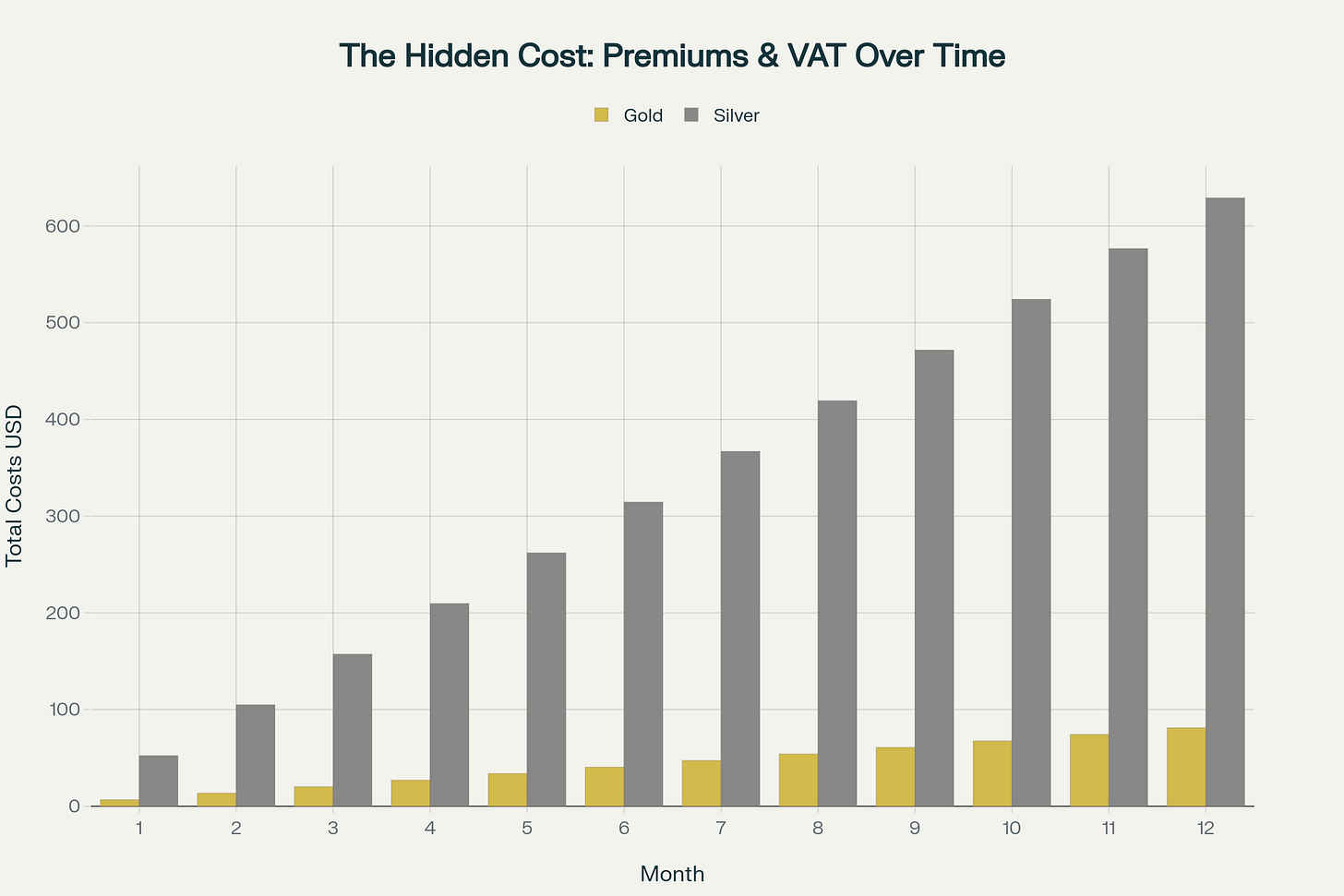

Over 25 years, the gold investor paid €1,765 in dealer spreads—just 2.91% of total investment. The silver investor? They paid €5,879 in spreads PLUS €9,497 in VAT, for a combined €15,376 in fees—25.37% of their total investment.

That’s right: more than one quarter of every euro invested in silver was immediately lost to taxes and fees. The silver never even got a chance to grow before losing 25% of its value.

The Breakeven Trap

Here’s where it gets worse. To simply break even—not make a profit, just get back to your original investment—each metal needs to appreciate enough to overcome those entry costs.

Gold needs to rise 3.5% to break even

Silver needs to rise 35.5% to break even

That means silver must rally ten times harder than gold just for you to get back to zero. Yes, silver is more volatile and can make bigger percentage moves. But it also crashes harder, and you’re starting from a 35% hole before the race even begins.

When Silver Makes Sense (And When It Doesn’t)

I’m not saying silver is a bad asset. It has legitimate investment cases:

Silver works if:

You believe industrial demand (solar, EVs) will drive prices up 50%+ in coming years

You’re already wealthy and allocating a small speculation portion to high-volatility metals

You’re buying in VAT-free jurisdictions (limited options exist)

You’re a trader capitalizing on silver’s 2-3x volatility versus gold

Silver fails if:

You’re a regular person dollar-cost-averaging small amounts monthly

You need to access liquidity on short notice (you’ll eat another spread selling back)

You can’t afford to wait years for a 35%+ rally just to break even

You want stable wealth preservation rather than speculation

For the vast majority of investors putting away $200-500 monthly, gold’s tax exemption and lower spreads create a structural advantage that silver simply cannot overcome.

The Simple Truth

Investing is about keeping more of your money working for you. With gold, 96.6% of your capital goes toward actual metal that tracks market prices. With silver, only 73.8% does—the rest is lost to taxes and fees before you even start.

The silver enthusiasts will tell you about industrial demand, supply deficits, and the gold-silver ratio. All true. All interesting. But none of it matters if you’re giving away 26% at the door.

Gold isn’t better because it’s shinier or more prestigious. It’s better because the math works in your favor. In a world where every percentage point of return matters, starting with a 23-point handicap makes no sense—and 25 years of real market data proves it conclusively.

Quick Comparison

The numbers don’t lie. When you’re investing for the long term, gold’s tax-free status and tighter spreads make it the clear winner for wealth preservation.

This article provides educational information only and is not financial advice. The author is not a licensed financial advisor. Precious metals investing carries risk, and past performance does not guarantee future results. Tax laws and dealer costs vary by location and change over time. Always consult qualified professionals before making investment decisions. The author is not responsible for decisions made based on this content.