For a decade, the investment world was sold a seductive narrative: Bitcoin is Gold 2.0. We were told that when the fiat system finally cracked, when inflation entrenched itself, and when global stability fractured, capital would flee to the “pristine collateral” of the blockchain.

We are now in January 2026. The fiat cracks are here. The geopolitical temperature is boiling.

And what did the market do? It didn’t buy the code. It bought the metal.

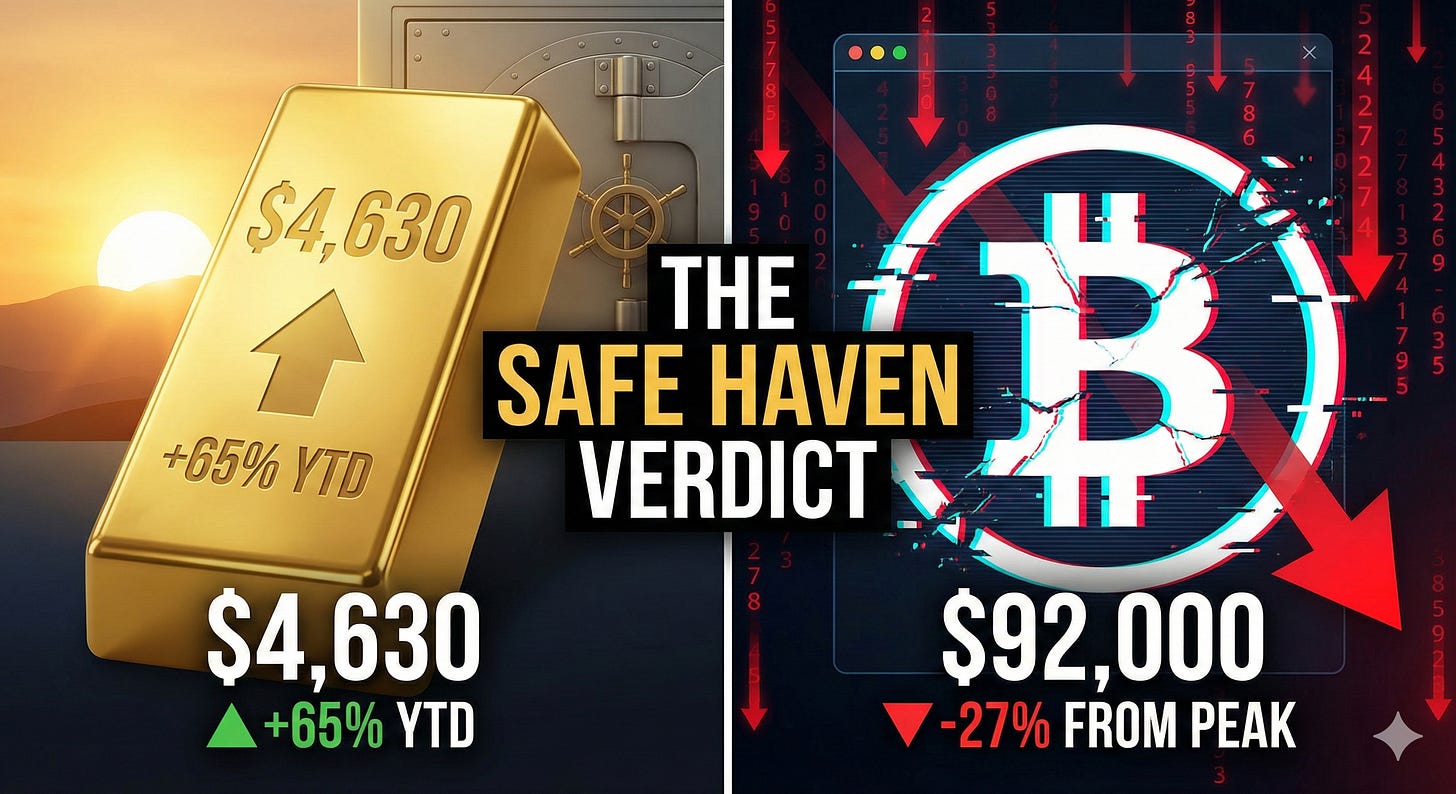

As of this morning, Gold is trading near ~$4,630/oz—holding onto an astonishing ~65% gain recorded over the last 12 months.

Meanwhile, Bitcoin sits at ~$92,000. While this is a recovery from its recent lows, it remains down ~27% from its October 2025 peak of ~$126,000. While Gold marched steadily upward with low volatility, “Digital Gold” proved to be just another risk asset, shedding value exactly when investors needed safety the most.

Here is why the “Digital Gold” thesis collapsed in 2025, and why the “Old Guard” is just getting started.

1. The “Smart Money” Voted with Tonnes, Not Tokens

The most verifiable claim in finance right now is simple: Central Banks do not care about crypto.

In 2025, while retail investors argued on X (formerly Twitter), Central Banks quietly bought a record-breaking volume of physical gold.

The Global South accelerated its swap of U.S. Treasuries for bullion to sanction-proof their reserves.

Institutional Demand was inelastic; they bought regardless of the price rising from $3,000 to $4,500.

This is not speculation; it is public record. These institutions manage the safety of nations. When they felt fear in 2025, they didn’t download a wallet. They vaulted bars. This “Whale Bid” creates a price floor for Gold that Bitcoin simply does not possess.

2. The Volatility Reality Check

The primary job of a “Store of Value” is to let you sleep at night.

Gold in 2025: A boring, steady climb. It acted as the perfect hedge, rising ~65% in a single year to outperform the S&P 500.

Bitcoin in 2025: A heart-stopping rollercoaster. It surged to $126,000 in October, only to crash back down when liquidity tightened.

If you bought Bitcoin to get rich, you might still be fine. But if you bought it to preserve wealth, 2025 was a failure. An asset that drops nearly 30% from its highs during a crisis is not a safe haven; it is a high-beta tech stock in disguise.

3. The “Vindication” of Physical Assets

We are witnessing a rotation from intangible to tangible. The premium on physical coins and bars has remained high throughout late 2025, indicating that this isn’t just paper trading—people want delivery. They want the asset that has survived every empire collapse for 5,000 years, not the one that depends on grid stability.

The Verdict

I am not saying Bitcoin is going to zero. At $92,000, it clearly has demand as a speculative asset.

But let’s stop pretending it is “Gold 2.0.” Gold 2.0 is just Gold.

And at $4,630, the market is telling us that the original safe haven is the only one that matters when the chips are down.