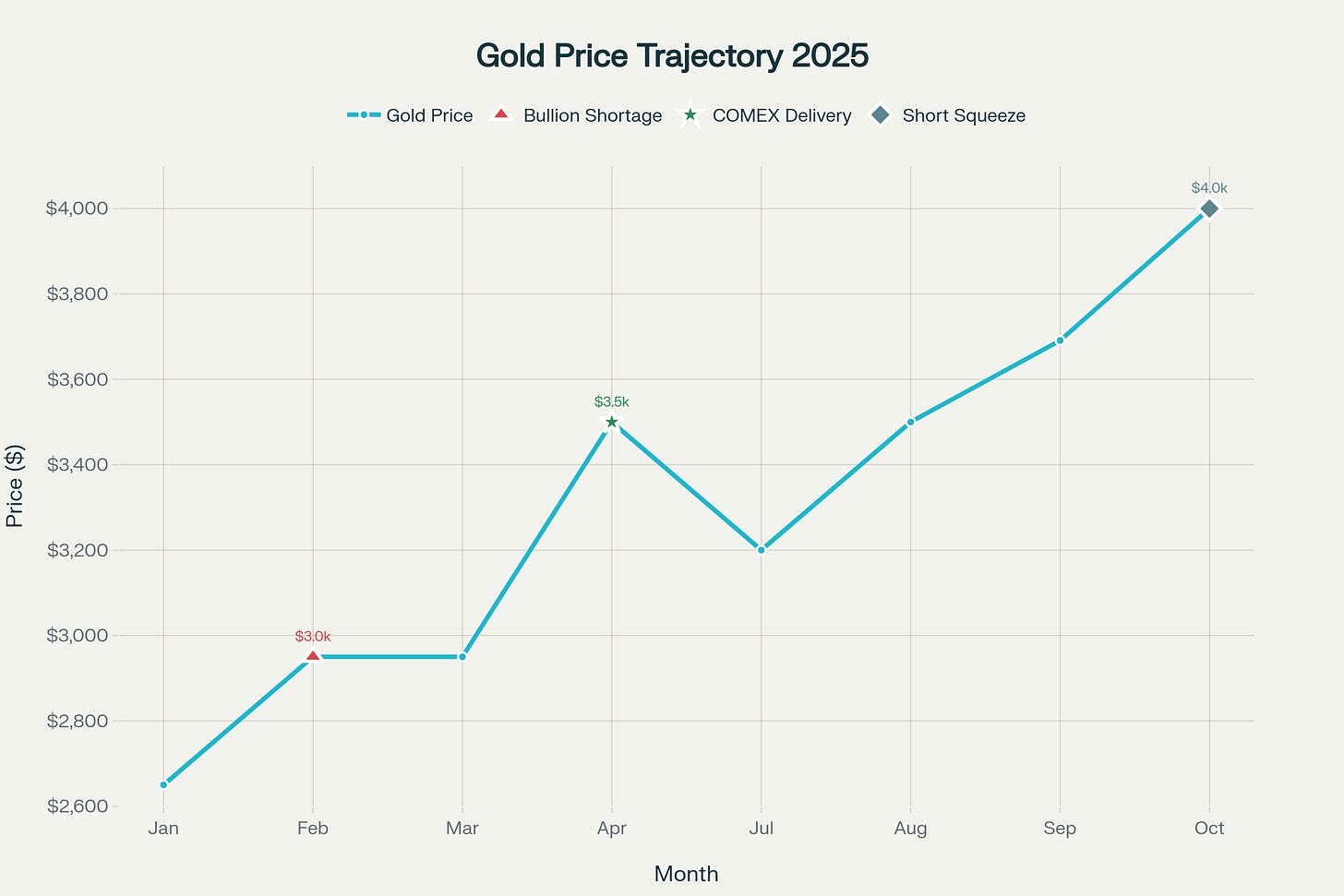

The gold market stands at a critical juncture in October 2025, with prices reaching unprecedented heights above $4,000 per ounce—a staggering 51% increase year-to-date. Behind this meteoric rise lies a potentially explosive situation that could reshape precious metals markets: the mounting evidence of a systematic short squeeze driven by an unsustainable fractional reserve system where up to 250 paper gold certificates may claim ownership of each physical ounce. This investigation reveals how decades of market manipulation, regulatory gaps, and the fundamental disconnect between paper and physical gold markets have created conditions for what could become the most significant precious metals crisis in modern financial history.

The Paper Gold Pyramid: Understanding the Leverage Problem

The Scale of Market Dislocation

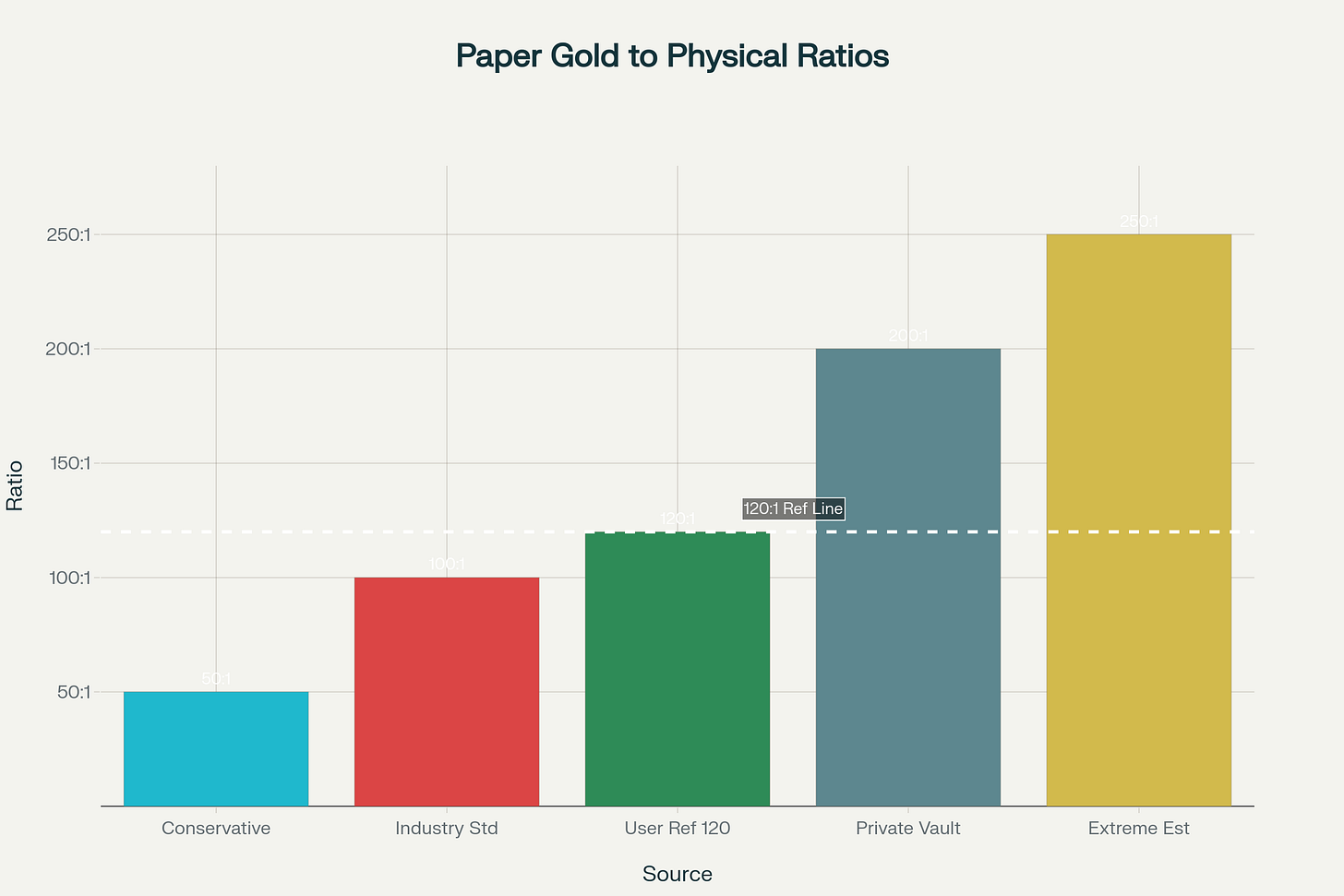

Current research indicates that the paper gold market operates on leverage ratios that would make traditional banks blush. While conservative estimates suggest 50-120 paper claims exist for every physical ounce, more alarming analyses point to ratios as high as 200-250:1. The London Bullion Market Association (LBMA), which dominates global gold trading, processes over 2,134 tonnes of gold daily through unallocated accounts—yet holds only an estimated 15,000 tonnes of physical gold to back these massive flows.

This fractional reserve system operates similarly to traditional banking but with far less oversight. When institutions sell “unallocated” gold, buyers receive merely a contractual promise rather than ownership of specific bars. As one industry analysis reveals, “95% of all precious metals traded on the interbank/wholesale/OTC market clear over unallocated Loco London accounts”. This means that in a crisis scenario where even 10% of paper gold holders demanded physical delivery, the system would face catastrophic shortfalls.

The Mechanics of Modern Gold Banking

Bullion banks have perfected a system that mirrors fractional reserve banking but operates with minimal regulatory oversight. When a mining company deposits gold, the bank can legally lend that same gold multiple times through unallocated accounts. Each loan creates new “paper gold” in the system while the underlying physical metal may be simultaneously claimed by multiple parties.

The Bank for International Settlements has estimated that the total notional amount of over-the-counter gold derivatives exceeds $500 billion, representing claims on gold far beyond what physically exists in allocated storage. This creates what economist Murray Rothbard would have recognized as a classic pyramid structure—one where the foundation of physical metal cannot support the superstructure of paper claims built upon it.

COMEX Under Siege: The Delivery Revolution

Unprecedented Physical Demand

The Commodity Exchange (COMEX) has witnessed a fundamental shift in market behavior that threatens its traditional operating model. Historically, less than 1% of futures contracts resulted in physical delivery, with most positions rolled forward or settled in cash. This low delivery rate allowed the exchange to operate with minimal physical inventory relative to open interest.

However, 2025 has shattered these precedents. In August 2025, delivery rates reached 100% for certain contract periods, with 20,160 gold contracts standing for delivery in just the first three days—representing approximately 2,016,000 ounces worth roughly $7 billion. Current COMEX open interest stands at 528,789 contracts, representing over 52 million ounces of gold claims against physical inventory of approximately 40 million ounces—a coverage ratio that has fluctuated between 60-98% throughout 2025.

The Great Metal Migration

Perhaps most significant is the unprecedented flow of gold from London to New York. Reports indicate that between 400-2,000 metric tons of gold have moved from LBMA vaults to COMEX warehouses—the largest such transfer since the post-World War II monetary reorganization. This migration reflects growing distrust in the London unallocated system and demand for allocated, physically-backed positions.

Stone X, a respected LBMA member, has independently confirmed approximately 2,000 metric tons of gold flowing into American vaults, both through and outside official COMEX channels. This represents more than half of annual global gold mine production being relocated to satisfy physical delivery demands—a clear signal of stress in the traditional paper-based trading system.

Regulatory Pressure and Basel III: The Tightening Vice

Banking Rule Changes Accelerate Physical Demand

The implementation of Basel III banking regulations has fundamentally altered the economics of gold banking. Under the Net Stable Funding Ratio (NSFR), banks must now maintain 85% stable funding for unallocated gold positions, while physical allocated gold receives a 0% risk weighting. This regulatory shift makes paper gold positions increasingly expensive for banks to maintain while incentivizing conversion to physical holdings.

The London Bullion Market Association has been forced to clarify that despite online speculation, gold has not been reclassified as a High-Quality Liquid Asset (HQLA) under Basel III. However, the preferential treatment of physical allocated gold over unallocated positions creates powerful incentives for market participants to demand actual metal rather than paper promises.

Central Bank Accumulation Patterns

Central banks have emerged as the most significant gold buyers of the modern era, purchasing over 1,000 tonnes annually for three consecutive years through 2024. This official sector buying represents a structural shift away from the dollar-centric reserve system established at Bretton Woods. J.P. Morgan Research projects continued central bank purchases of approximately 900 tonnes in 2025, driven by “diversification away from U.S. dollar reserve holdings” and “shifting, more unpredictable geopolitical alliances”.

The timing of this accumulation coincides with mounting evidence of dollar debasement policies and fiscal dominance over monetary policy. As Sprott Asset Management analysis indicates, “Financial repression is the mechanism through which this cost is transmitted. Policy rates are being set below the neutral rate. Rising gold and global 30-year yields have become the market’s protest vote”.

The Manipulation Evidence: From Conspiracy Theory to Court Record

Documented Market Manipulation Cases

The narrative of gold price manipulation has moved from conspiracy theory to documented legal fact through a series of landmark prosecutions. JPMorgan Chase agreed to pay a record $920 million in 2020 for manipulative trading practices spanning eight years, including hundreds of thousands of “spoof” orders designed to deceive other market participants. Michael Nowak, former head of JPMorgan’s precious metals desk and LBMA board member, was convicted on multiple fraud charges, demonstrating manipulation at the highest levels of the gold market establishment.

The Department of Justice utilized racketeering laws typically reserved for organized crime prosecutions, characterizing JPMorgan’s precious metals desk as operating “as an illicit enterprise within the bank for almost a decade”. Similar prosecutions have targeted Deutsche Bank ($30 million fine), UBS ($15 million), and HSBC ($1.6 million) for precious metals manipulation.

The Spoofing Epidemic

Court documents reveal that major banks systematically used “spoofing” techniques—placing large orders with no intention of execution to manipulate prices in desired directions. These practices were so endemic that prosecutors described them as creating “artificial prices” through “false signals of supply or demand designed to deceive market participants”.

Former Deutsche Bank trader James Vorley received a one-year prison sentence in 2021 for manipulative trading, while multiple JPMorgan traders faced similar prosecutions. The systematic nature of these violations across multiple institutions suggests coordinated market manipulation rather than isolated incidents of misconduct.

Short Squeeze Mechanics: When Paper Promises Fail

The Physical Delivery Crisis

Current market dynamics suggest the gold market may be approaching a Warren Buffett-style delivery crisis. When Buffett demanded delivery of 130 million ounces of silver in the 1990s, COMEX could only immediately deliver 90 million ounces, with the remainder delivered later at lease rates reaching 17%. The current gold market faces similar vulnerabilities on a much larger scale.

LBMA silver inventories provide a concerning precedent, with industry expert Eric Young estimating that just three consecutive days of substantial physical delivery demands could potentially deplete available allocated silver. Gold faces similar risks, with the 15,000 tonnes of physical gold backing the London market insufficient to satisfy the paper claims should delivery demands increase substantially.

Scenario Analysis: Price Impact Projections

Conservative analysis suggests various delivery scenarios could trigger dramatic price increases:

10% Delivery Demand: Price impact of $4,400-4,800 per ounce (High probability)

20% Delivery Demand: Price impact of $5,200-6,000 per ounce (Medium probability)

50% Delivery Demand: Price impact of $8,000-12,000 per ounce (Low probability)

100% Delivery Crisis: Price impact of $15,000-25,000 per ounce (Very low probability)

These projections assume current market structure and inventory levels. However, the precedent of Buffett’s silver squeeze demonstrates that even partial delivery demands can trigger exponential price increases and fundamental market disruption.

Market Structure Vulnerabilities

The London-New York Nexus

The global gold market operates primarily through two interconnected hubs: London’s over-the-counter spot market and New York’s COMEX futures exchange. London handles approximately 85% of global gold trading through unallocated accounts, while COMEX provides price discovery through futures contracts. This bifurcated structure creates arbitrage opportunities and systemic vulnerabilities.

The 4-8 week delays for spot gold delivery in London—unprecedented in modern bullion markets—signal severe stress within the traditional trading system. These delays, combined with the massive gold flows to New York, suggest participants are losing confidence in the London unallocated system’s ability to deliver physical metal when demanded.

The Role of Exchange-Traded Funds

Gold-backed ETFs hold substantial physical inventory but operate under structures that may not guarantee delivery in crisis scenarios. The SPDR Gold Trust (GLD), the world’s largest gold ETF, holds approximately 1,000 tonnes of gold but allows redemption only in 100,000-share blocks worth roughly $10 million. This high minimum effectively excludes individual investors from physical redemption, maintaining the paper-physical disconnect.

More concerning, authorized participants in ETF creation and redemption may contribute “baskets of purchased or borrowed assets,” meaning some ETF gold holdings could be subject to prior claims in a financial crisis. The Sprott Physical Gold Trust, with its 3.67 million ounces under management, offers lower minimum redemption requirements but still maintains structural barriers to individual physical access.

Chinese Market Dynamics: The Eastern Challenge

Shanghai Gold Exchange Alternative

China’s Shanghai Gold Exchange operates under fundamentally different principles than Western markets, with physical delivery being far more common than the 1% rate typical in COMEX. This creates an alternative pricing mechanism and physical demand center that increasingly influences global gold flows.

Recent developments include major Chinese insurance companies—PICC, China Life Insurance, and Pingan Life Insurance—becoming Shanghai Gold Exchange members, representing a strategic pivot toward hard assets. New regulations allow these insurance giants to invest up to 1% of their massive asset pools in gold, potentially representing hundreds of tonnes of additional demand.

Strategic Reserve Building

China’s continued gold accumulation through official and unofficial channels represents perhaps the most significant long-term challenge to Western gold market structure. Reports indicate Chinese entities have expanded doré purchasing activities in South America, acquiring semi-refined metals directly from miners for domestic refining. This circumvents traditional market channels and reduces transparent price discovery mechanisms.

The combination of domestic refining capacity expansion and strategic reserve building creates what analysts describe as a “parallel gold market” operating outside the London-New York nexus. This Eastern alternative may provide the catalyst for a fundamental repricing of gold should Western paper markets experience delivery failures.

The Coming Reckoning: Warning Signs and Triggers

Technical Indicators Flash Red

Multiple technical indicators suggest the gold market is approaching historically dangerous territory. The Commitments of Traders report shows commercial traders holding a net short position of 298,403 gold futures contracts as of September 2025—a sharp increase that historically precedes significant market corrections or short squeezes. However, traditional technical analysis may prove inadequate in a structural shortage scenario.

Sentiment indicators show “euphoric” levels of optimism, typically associated with market tops. Yet this analysis may not account for the fundamental supply-demand imbalance created by the fractional reserve system. Unlike typical speculative bubbles, the current gold rally is driven by physical shortage rather than speculative excess.

Potential Catalysts for Crisis

Several scenarios could trigger a cascade of physical delivery demands:

Regulatory Enforcement: Increased scrutiny of unallocated accounts could force allocations

Geopolitical Crisis: Military conflicts or monetary system breakdown could trigger flight to physical assets

Bank Failures: Collapse of major bullion banks could expose fractional reserve practices

Currency Crisis: Dollar devaluation could accelerate central bank and institutional gold accumulation

Technical Default: Failure to deliver on existing contracts could trigger confidence collapse

The Liquidity Illusion

The gold market’s apparent liquidity masks underlying fragility. While daily trading volumes suggest deep markets, this activity occurs primarily in paper instruments backed by minimal physical inventory. As JPMorgan’s Ken Griffin warned, investors are “beginning to perceive gold as a safer option than the dollar,” creating conditions where “significant asset inflation away from the dollar” accelerates.

This shift in perception, combined with the structural imbalances in paper markets, creates what Austrian economists would recognize as an unsustainable boom built on credit expansion rather than genuine savings and production.

Conclusion: The Perfect Storm Approaches

The evidence overwhelmingly supports the thesis that gold markets face an unprecedented structural crisis. The combination of fractional reserve banking in precious metals, documented manipulation by major institutions, regulatory changes favoring physical holdings, and massive central bank accumulation has created conditions for a potential short squeeze of historic proportions.

The 120:1 ratio of paper to physical gold claims, while difficult to verify precisely, reflects a market structure fundamentally divorced from physical reality. Current gold prices above $4,000 per ounce may represent not speculative excess but the early stages of a repricing process that could ultimately reach levels previously considered impossible.

For investors, the implications are profound. Traditional portfolio allocation models assuming 5-10% gold exposure may prove inadequate in a scenario where physical metal becomes genuinely scarce. The choice between allocated physical holdings and paper alternatives may determine not just investment returns but actual wealth preservation in the coming monetary transition.

The gold short squeeze represents more than a trading opportunity—it embodies the inevitable reckoning between paper promises and physical reality that has defined monetary history for millennia. As this analysis demonstrates, the foundations of the current system are cracking, and the consequences may reshape not just gold markets but the entire international monetary order.

The question is not whether a gold short squeeze will occur, but when and how severe its impact will be. Current market dynamics suggest the answer may come sooner than most participants expect, with consequences that will reverberate through financial markets for years to come.