As of 16 February 2026 (Europe/Berlin). Market commentary, not financial advice.

If you’ve looked at gold lately and thought, “Wait—how did we get here?” you’re not alone.

Gold hovering around $5,000/oz isn’t a normal “late-cycle hedge” story anymore. It’s a story about trust, policy, and geopolitics—with a paper market that still sets the marginal price, and a physical market that’s quietly reasserting its importance.

This piece breaks down what the market is telling us right now, why it matters, and how to think about gold’s short-, mid-, and long-term future—without getting lost in trader jargon.

1) The “headline move” vs. the real signal

Yes, gold pulled back a bit into mid-February after running to fresh highs earlier in the year. But the bigger message isn’t the dip.

The message is: gold is behaving like a strategic asset, not a commodity.

When gold trades at levels that overwhelm jewelry demand and still holds up, you’re looking at demand that’s less price-sensitive and more policy-driven—central banks, reserve diversification, and capital seeking “neutral” collateral.

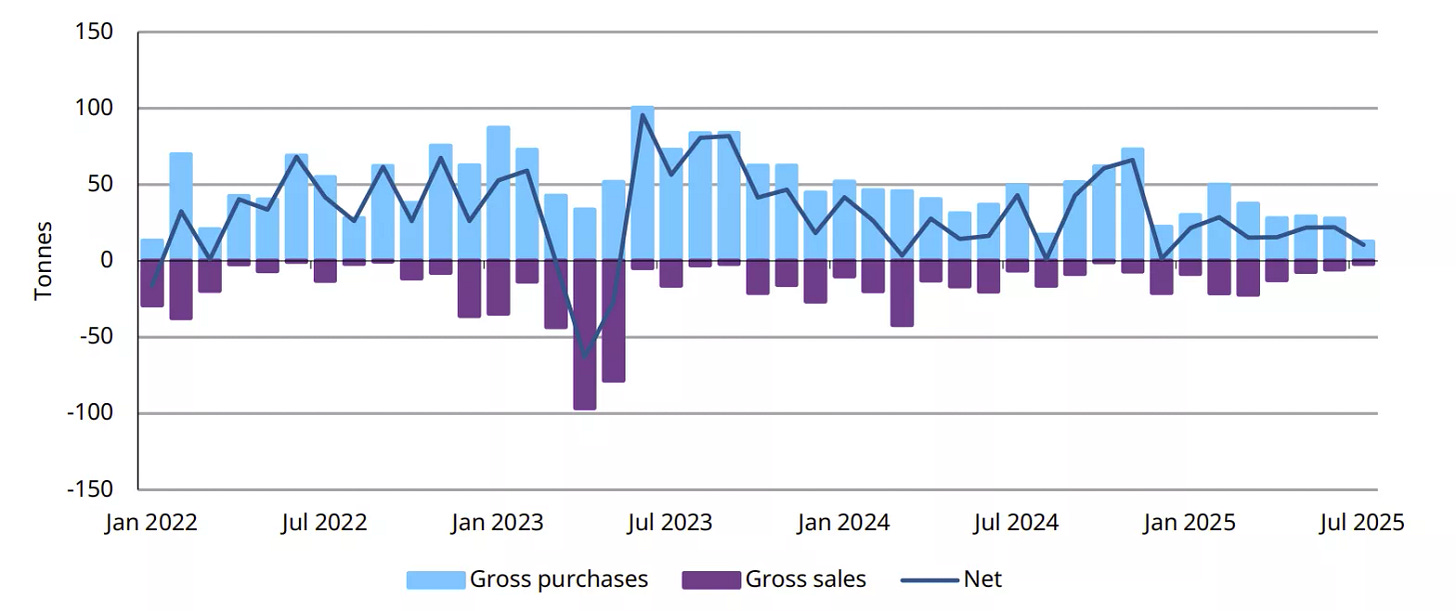

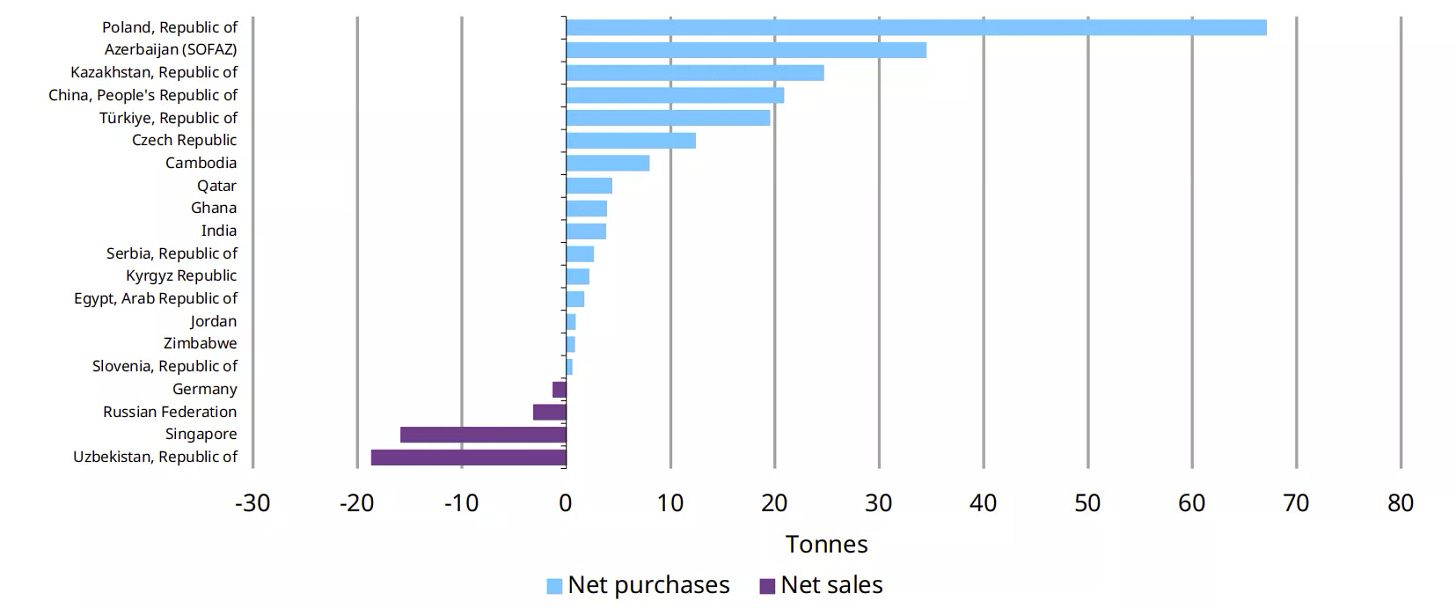

2) Physical market: the structural bid is official

Central banks are the backbone

The most durable pillar under gold right now is official-sector buying.

When central banks buy gold, it tends to be:

longer-term

less likely to panic-sell

motivated by things that don’t go away (reserve diversification, sanctions risk, geopolitical fragmentation)

That’s why gold can stay high even when speculative flows wobble.

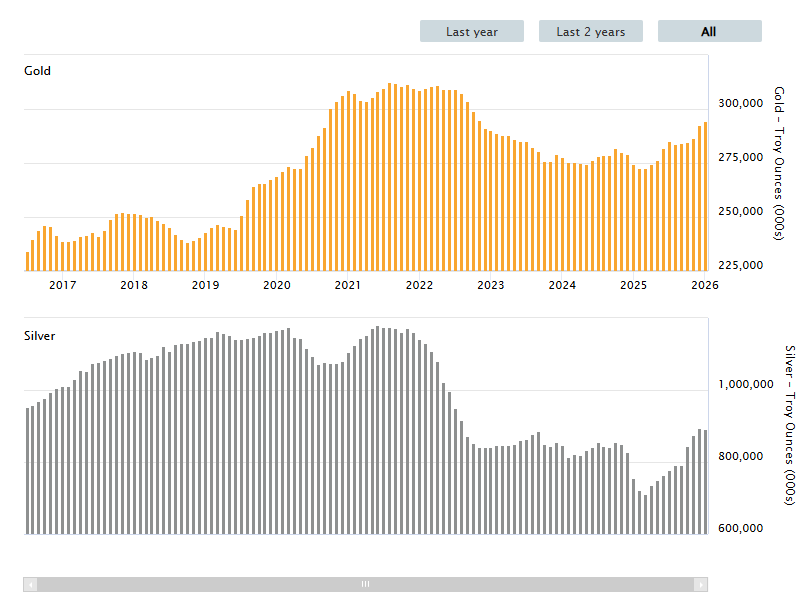

ETFs are still the “Western volume knob”

ETFs (especially the big ones) can flip sentiment fast. Even in a central-bank-driven regime, ETF flows can amplify moves both ways.

3) Mine supply: high prices don’t create new ounces overnight

Gold isn’t like oil where supply can ramp quickly. New mines take years:

exploration → feasibility → permits → financing → construction → production

Even with record prices, the system can’t instantly flood the market with new supply. And that matters because it means demand shocks—especially official-sector shocks—can have persistent effects.

Miners are making money… but constraints are rising

At $5,000 gold, margins are enormous on paper—but miners still face:

cost inflation (energy, labor, consumables)

permitting delays

political risk (taxes/royalties rise when prices rise)

capital discipline (boards don’t want “growth at any price” again)

So the mining response may be: more exploration, more optimization, fewer reckless mega-bets.

4) The paper market: where the price is still “made”

Let’s say this plainly:

Most day-to-day gold price discovery happens through paper claims:

London OTC (forwards/unallocated accounts)

COMEX futures/options

That does not mean paper is “fake.”

It means the market clears through contracts, and physical tightness shows up indirectly: spreads, premia, inventories, delivery dynamics.

CFTC positioning shows speculative heat

Managed Money positioning has been heavily net long—great for momentum, dangerous when macro shocks hit.

London vaults: the physical “balance sheet”

London remains the key physical hub behind the OTC system. Vault levels help you understand whether bullion is accumulating, migrating, or being stressed.

5) Geopolitics: the gold bid that doesn’t show up in CPI

Here’s the core geopolitical link to gold in 2026:

Gold is neutral collateral in a world where money is increasingly political.

Three forces matter most:

Sanctions & reserve security

If a country worries its FX reserves could be frozen, gold becomes more attractive.

Fragmentation of trade and payment rails

Multipolar systems prefer assets that don’t require another nation’s balance sheet.

Resource nationalism

As gold rises, governments often tighten their grip (royalties, taxes, export rules), which can cap supply expansion and raise risk premia.

6) What the market is telling us (in one sentence)

Gold near $5,000 is the market pricing a trust premium: not just inflation, but policy risk + geopolitical risk + reserve diversification—with supply too slow to quickly neutralize it.

7) The outlook: short, mid, long term

Short term (0–3 months): Volatile consolidation

Gold is expensive, sentiment is crowded, and positioning is heavy.

Base case: choppy range with sharp drops and fast rebounds.

Bear triggers (short term):

USD strength spikes

real yields jump

risk-on euphoria drains hedges

managed money de-levers

Bull triggers (short term):

geopolitical escalation

dovish pivot expectations

fresh ETF inflows

strong official-sector buying headlines

Middle term (3–18 months): Tug-of-war between rates and policy demand

This is where the regime is decided.

If real yields grind higher and growth is stable, gold can correct meaningfully—but strong central bank demand can “raise the floor” compared to past cycles.

If rates soften and geopolitical risk persists, gold can resume its climb—possibly in bursts, not a smooth line.

Long term (2–10+ years): Structural support, but cyclical drawdowns

Long term, gold’s bullish case rests on:

reserve diversification becoming permanent behavior

slow mine supply response

debt/fiscal credibility questions

recurring geopolitical fragmentation

But gold can still experience long drawdowns when:

real yields remain convincingly positive

geopolitical risk premia fade

speculative demand dries up

Think of long-term gold as supported—but not linear.

Closing thought

In 2026, gold isn’t just reacting to inflation prints. It’s reacting to something deeper:

A world where “risk-free” is political, and gold is the asset that doesn’t need permission.