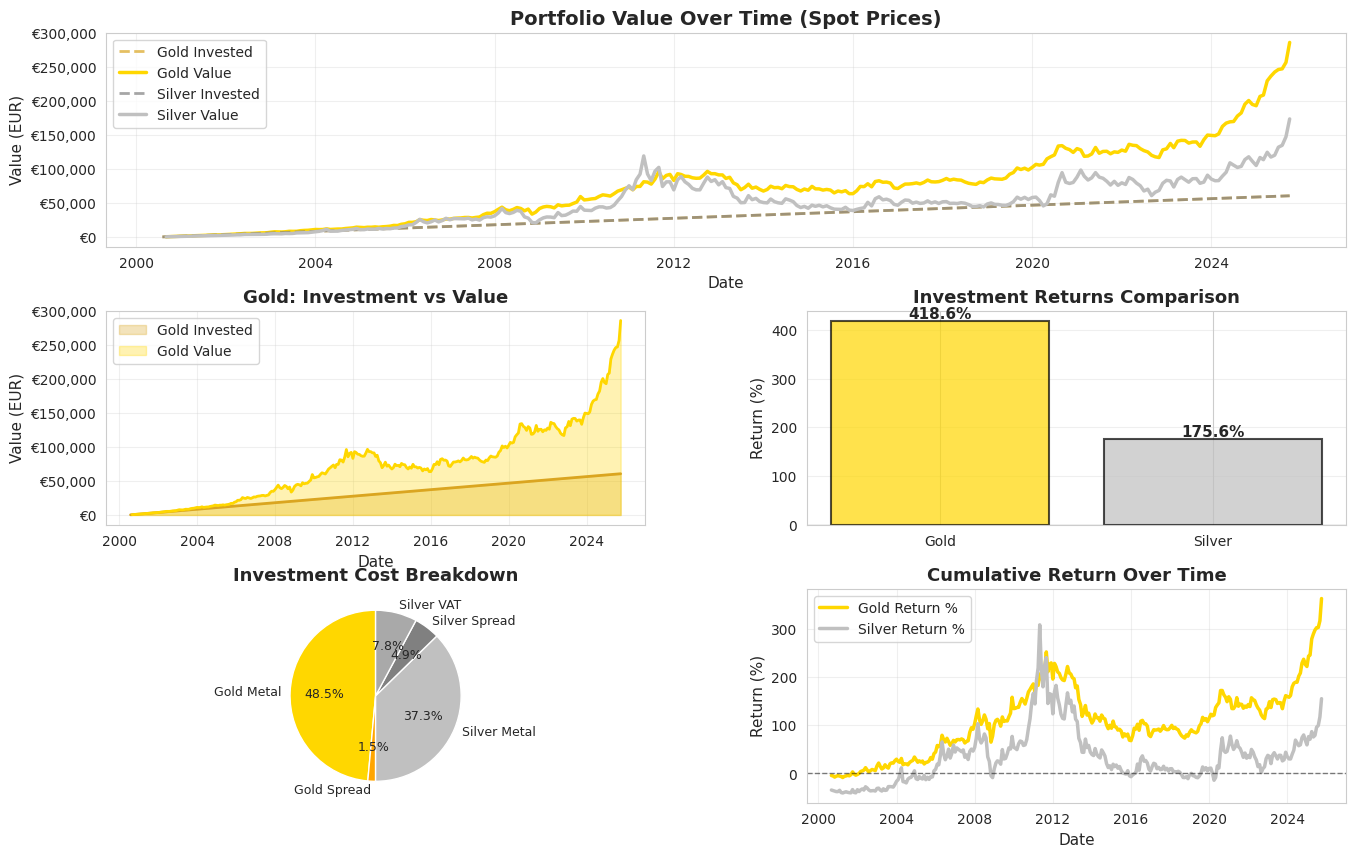

Why Gold Beats Silver: The Math Nobody Tells You

Silver stackers are losing 26 cents on every dollar to taxes and spreads. Here's the data they don't want you to see.

What's performing well in fiat money (Dollars, Euros, etc.) might be losing value in gold. Track how assets, currencies, and economies perform against the one form of money that is for thousands of years.

The Modern Way to Measure Real Value-97%

USD purchasing power lost vs gold since 1971

5000+

Years as a reliable store of value

0

Central banks control gold supply

See how major assets perform when measured in gold. This removes the distortion of currency debasement and shows true value changes.

Explore our latest articles analyzing assets, economies, and currencies when measured in gold—revealing insights beyond fiat currency measurements.

Why This Ancient Metric Could Help You Stack Smarter in 2025

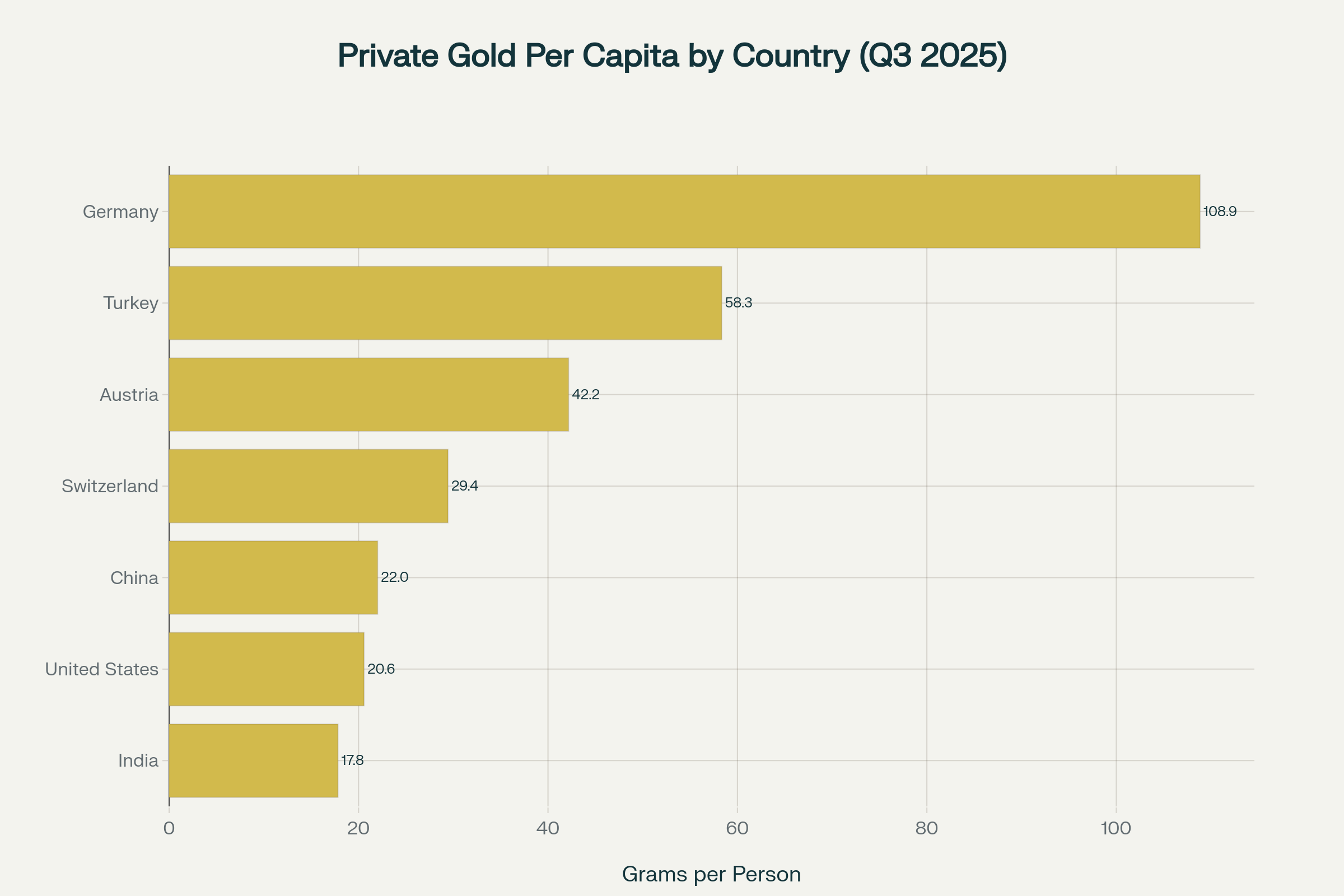

Where the world's private gold sits, who owns it, and why everyone's suddenly buying

A Roman soldier could buy a horse in 10 months. Can you buy a car in 10 months? Let's find out if modern engineers are actually poorer than ancient legionaries—and the answer might surprise you.

When central banks print trillions in new currency, comparing investments in dollars gives a distorted view. Gold provides an honest baseline for measurement.

Strip away inflation effects to see real performance. Has Bitcoin really outperformed Tesla? Did Apple outperform silver?

Explore AssetsWhich currencies are being debased the fastest? Track purchasing power across the USD, EUR, JPY and others in gold terms.

Compare CurrenciesIs China's economy really growing faster than the US in real terms? See GDP measured in gold to reveal the truth.

View EconomiesSee through monetary policy distortions and identify true value changes

One standard for comparing assets, currencies, and economies worldwide

Gold has maintained purchasing power for thousands of years unlike fiat currency

Unlike fiat, gold's annual supply growth is limited to ~1.5% by mining output